April 23, 2024

What is payment authentication?

Payment authentication is a critical process that ensures transactions are authorized by the rightful account holder and secure from fraudulent activities. This process is especially vital in the digital era, where the volume and frequency of online transactions have dramatically increased. Understanding payment authentication is crucial for anyone involved in the processing of electronic payments.

In addition to enhancing security, effective payment authentication methods also contribute to a smoother customer experience. By minimizing the risk of fraud, businesses can reduce the occurrence of transaction disruptions and declined payments, which often frustrate customers. This support of a seamless transaction flow is crucial in today’s fast-paced market, where consumers expect quick and hassle-free payment processes. Thus, payment authentication not only protects against security breaches but also helps maintain customer satisfaction and loyalty.

How does payment authentication work?

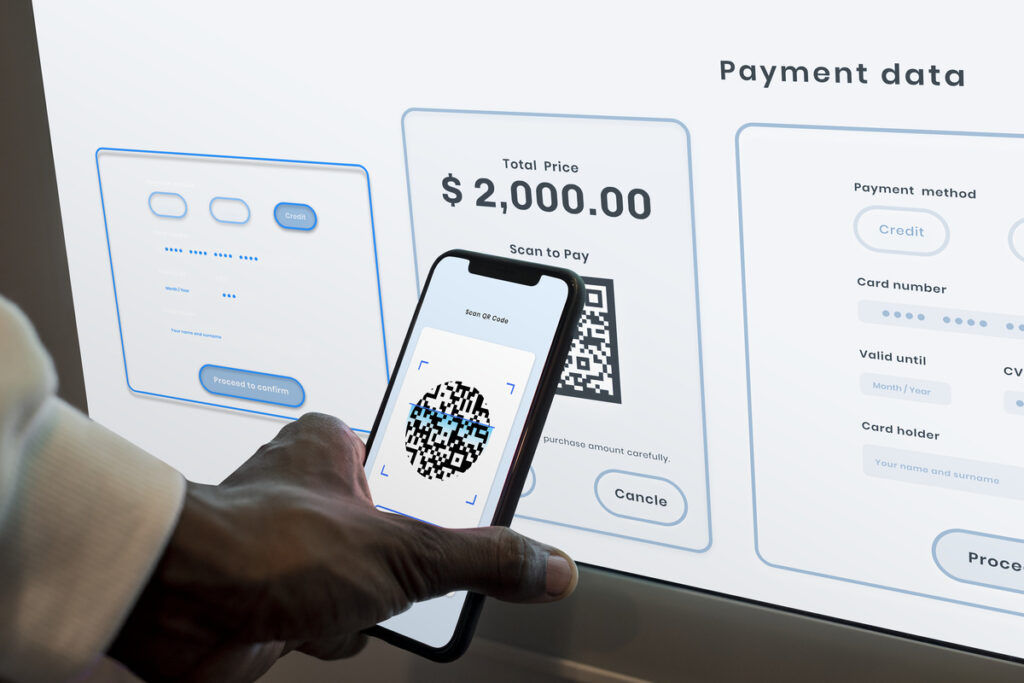

At its core, payment authentication works by verifying the identity of the person initiating the transaction. This is done through various methods that confirm whether the payment details provided by a user are valid and that the person using them is authorized to do so. The process involves multiple checks and balances, which can include password verification, biometrics, one-time passwords (OTPs), or even behavioral analytics.

For instance, when a transaction is initiated, the payment gateway may send an OTP to the registered mobile number of the cardholder. This simple step adds an extra layer of security by ensuring that the person attempting the transaction has access to the physical device associated with the account.

What does it mean to authenticate a payment?

To authenticate a payment means to verify the legitimacy of the transaction by confirming the identity of the person making the payment. This step is essential in preventing unauthorized access and reducing the risk of fraud. Authentication can occur at various stages of a transaction, depending on the security protocols of the issuing bank or financial institution.

Authentication serves as a crucial barrier against potential security threats, ensuring that the individual attempting the transaction has the right to use the payment method being presented. This could be as straightforward as entering a PIN during a debit card transaction at a retailer, or as advanced as providing a fingerprint for a mobile payment through a smartphone. Each method of authentication is designed to confirm that the user initiating the payment is the true owner of the funds or credit being accessed.

The necessity for such verification becomes increasingly important in an age where digital transactions can be initiated remotely and across borders. Banks and financial institutions continuously update and enhance their authentication processes to address new and evolving security challenges. These measures not only protect individuals’ financial assets but also maintain the integrity of the financial system as a whole.

What is payment authorization?

Payment authorization is a different yet closely related process to authentication. It involves checking whether the cardholder has sufficient funds and whether the card is valid for the transaction. Once a payment is authenticated, it must then be authorized before the transaction can be completed. This ensures that payments are not only secure but also feasible.

Authorization is a critical step in the payment process because it directly involves the financial institutions that manage the accounts. When a transaction is initiated, the merchant sends a request to the cardholder’s bank or credit card issuer to confirm that the account has the necessary funds or credit limit available. This request includes verifying that the card is active and not reported lost or stolen.

In addition to confirming financial capabilities, payment authorization also includes applying various checks for any anomalies or suspicious patterns that might suggest fraudulent activity. For example, if a card that is typically used in one geographic location suddenly makes a purchase in a very distant location, this may trigger additional security checks or require further verification before the transaction is approved.

For a deeper understanding of optimizing your payment processes, don’t miss our related article, “How to Maximize Payment Efficiency Through Payment Orchestration“. Discover strategies to streamline your transactions and enhance your authorization rates effectively.

What are the top payment authentication tools?

Several tools and technologies are at the forefront of securing online payments, playing a critical role in preventing fraud and unauthorized access. Let’s delve deeper into some of the top payment authentication tools currently in use:

- Two-Factor Authentication (2FA): This method enhances security by requiring two distinct forms of identification before granting access to an account or validating a transaction. Typically, this involves something the user knows (like a password or PIN) combined with something the user has (such as a mobile device to receive an OTP) or something the user is (using biometric data). For example, after entering a password, a user may need to enter a code sent via SMS or generated by an authentication app.

- Biometric Authentication: As technology advances, so does the use of unique biological characteristics for authentication purposes. Biometric authentication includes fingerprint scanning, facial recognition, voice recognition, and even iris scanning. This technology offers a high level of security as these traits are nearly impossible to replicate or steal, making it an excellent tool for securing mobile and digital payments.

- Tokenization: This technology enhances payment security by substituting sensitive card details with a randomly generated number known as a token. These tokens can then be used without exposing actual bank details or credit card numbers. Tokenization is crucial for online transactions and services like Apple Pay, Google Wallet, and other digital payment platforms where maintaining the confidentiality of user data is paramount.

- Risk-Based Authentication (RBA): This adaptive approach evaluates the risk level of a transaction based on various factors, such as the user’s location, device identification, and behavior patterns. If the transaction is deemed high-risk, additional authentication steps are triggered. This method allows for a dynamic and responsive authentication process that aligns the level of security with the level of risk.

- SMS and Email One-Time Passwords (OTPs): This method involves sending a one-time code to the user’s registered phone number or email address, which they must enter to complete the transaction. OTPs are easy to implement and widely used, providing an effective layer of security by ensuring that the transaction is authorized by the rightful owner of the account.

- Authentication Apps: Apps like Google Authenticator, Microsoft Authenticator, and Authy provide a more secure alternative to SMS-based OTPs. These apps generate time-sensitive codes that sync with your account settings to facilitate secure logins. They are particularly useful for users who seek an additional layer of security, as they do not rely on potentially interceptable SMS messages.

By integrating these advanced tools, businesses can significantly bolster the security of their transaction processes. This not only minimizes the risk of fraudulent activities but also builds trust with customers, ensuring a safe and secure environment for conducting digital transactions.

To further secure and streamline your payment processes, delve into our detailed exploration of “What is Vaulting and Tokenization?“. Understanding these critical techniques will enhance your knowledge of secure payment handling and improve your overall authorization strategy.

Which methods do banks use to authenticate your payments?

Banks use a variety of robust methods to authenticate your payments, ensuring the security and integrity of each transaction. Here’s a closer look at each of these methods:

- PINs (Personal Identification Numbers): This is one of the most fundamental forms of authentication. A PIN is a secret number that a bank issues to the account holder. When you perform a transaction, especially at ATMs or during debit transactions at point-of-sale (POS) terminals, you are required to enter this number. Only the correct entry of your PIN allows the transaction to proceed, acting as a first line of defense against unauthorized access.

- Challenge Questions: Also known as security questions, these are personalized questions selected by the user or the bank and answered when the account is set up. These questions are designed to be answerable only by the account holder. Common examples include the name of your first pet, your mother’s maiden name, or the city where you were born. This method is often used for recovering access to an account or for further verification during unusual or high-value transactions.

- Transaction Signing: This advanced method is used particularly in the context of online banking and high-value transactions. Transaction signing involves generating a unique, one-time code for each transaction. This code must be entered as part of the transaction process and is usually generated by a secure physical device (known as a hardware token) or a software application. The unique nature of the code ensures that even if transaction details are intercepted, they cannot be reused fraudulently.

- Biometric Verification: Increasingly, banks are employing biometric verification as part of the authentication process. This involves using physical or behavioral human characteristics as an identity check. Common forms include fingerprint scans, facial recognition, voice recognition, and even iris scans. Because these attributes are unique to each individual, they offer a high level of security.

- Two-Factor Authentication (2FA): Many banks now require two-factor authentication for online banking transactions. This method requires the user to provide two different authentication factors to verify themselves. This could be something the user knows (like a password or PIN), something the user has (like a smartphone or a hardware token), and/or something the user is (like a fingerprint or facial recognition). This layered defense makes it much more difficult for unauthorized users to gain access to your accounts.

These methods collectively enhance the security of bank transactions, making it considerably harder for fraudsters to gain unauthorized access. By requiring multiple forms of verification, banks can better protect both their customers and their own systems from the growing threat of cyber attacks and fraudulent activities.

What is an example of transaction authentication?

A practical example of transaction authentication can be seen in the use of EMV chip technology in credit and debit cards. When you insert your chip card into a terminal, the chip generates a unique transaction code. This code cannot be used again and is different from what would be generated if someone attempted to copy your card’s magnetic stripe. This technology shows how dynamic authentication methods can help secure each transaction uniquely and effectively.

Another example of transaction authentication is the use of one-time passwords (OTPs) in online banking. When a customer attempts to transfer funds or make a payment online, the bank sends a unique code to the customer’s registered mobile phone or email. The customer must then enter this OTP into the banking portal to complete the transaction. This ensures that even if someone has stolen the user’s password, they would still need access to the OTP to proceed, significantly enhancing security.

Additionally, biometric authentication is becoming increasingly common, particularly in mobile payment platforms like Apple Pay and Samsung Pay. These systems use fingerprint scans, facial recognition, or even voice commands to authenticate transactions. For instance, when making a payment with Apple Pay, the user must authenticate the transaction using Touch ID (fingerprint) or Face ID (facial recognition). This type of biometric verification leverages unique personal attributes that are difficult to replicate, ensuring that the transaction is being authorized by the genuine account holder.

For businesses looking to enhance their payment security further and manage card data with maximum flexibility, Gr4vy’s Cloud Vault offers an exemplary solution. With Gr4vy’s Cloud Vault, businesses can store and manage their card data exactly how they want, enjoying PSP (Payment Service Provider) independency and data portability. This robust and scalable cloud infrastructure provides not only security but also the adaptability to meet the evolving needs of modern commerce.If you’re interested in enhancing your payment systems and ensuring that your transaction processes are as secure, efficient, and customer-friendly as possible, don’t hesitate to reach out to Gr4vy. Explore how Gr4vy can empower your business with advanced payment solutions tailored to your unique needs. Contact Gr4vy today to learn more about the Cloud Vault and take your payment security to the next level.