October 4, 2023

Understanding payment tokens: A comprehensive guide for business owners

- What is a payment token?

- Payment tokens: the backbone of tokenization

- An example of payment tokenization: enhancing security

- Network tokens: enhancing payment security

- Acquirer tokens: facilitating seamless transactions

- Issuer tokens: authorizing payment transactions

- Merchant tokens: simplifying payment processing

- The payment token number: decoding its significance

- How does tokenization work in payments?

- Types of payment tokens: exploring varieties

- Payment token crypto: securing transactions

- Payment tokens list: understanding variants

- Payment tokenization service providers: choosing the right partner

- Payment tokenization use cases: beyond transactions

In today’s dynamic business landscape, optimizing payment processes is key for any business, from small to big enterprises. An instrumental strategy in achieving this is the adoption of payment tokens. This article will delve into the intricacies of payment tokens, covering everything from network tokens to payment tokenization use cases, ultimately empowering businesses to enhance their payment strategy.

What is a payment token?

A payment token is a unique set of numbers generated from a PAN (primary account number) as a secure identifier. These are automatically issued and used online in payment environments or in specific domains, for example, selected online merchants.

Payment tokens: the backbone of tokenization

Payment tokens serve as the cornerstone of tokenization. They are unique, randomly generated codes that replace sensitive payment information. These tokens are used to represent the actual card data during transactions, minimizing the risk of unauthorized access. At the heart of tokenization lies the payment token, a dynamic code meticulously crafted to stand in place of sensitive financial information. This foundational element ensures that each transaction occurs with utmost security, shielding critical data from potential threats and breaches, thereby instilling trust in the payment process.

An example of payment tokenization: enhancing security

Imagine a customer making an online purchase. Instead of entering their actual card details, a payment token is used for the transaction. This token is meaningless to potential hackers, providing an additional layer of security for both the customer and the merchant. Picture a scenario where a customer initiates an online transaction. Rather than divulging sensitive card information, a payment token steps in as the guardian of security. This token, devoid of any exploitable meaning, acts as an impervious barrier against potential cyber threats, fortifying the safety of the transaction for both the customer and the merchant.

Network tokens: enhancing payment security

Network tokens play a pivotal role in securing payment transactions. These unique identifiers replace sensitive cardholder data with a token that is meaningless outside of a specific payment network. By doing so, network tokens add an extra layer of security, safeguarding customer information from potential breaches. This sophisticated security measure ensures that even if intercepted, the token holds no value or meaning to unauthorized entities, providing a robust shield against cyber threats.

Acquirer tokens: facilitating seamless transactions

Acquirer tokens act as intermediaries between merchants and payment networks. They enable the secure transmission of tokenized payment data, ensuring that transactions flow seamlessly from the point of sale to the payment network for processing. This seamless integration streamlines the payment process, assuring merchants and customers alike that their sensitive information remains safeguarded throughout the transaction journey. The use of acquirer tokens creates a trustful bridge between parties, optimizing the overall payment experience. However, it also limits the merchant flexibility to process with multiple acquires and PSP.

Issuer tokens: authorizing payment transactions

Issuer tokens are generated by the bank or financial institution that issued the original payment card. They serve as a link between the tokenized data and the actual account information. This process allows for smooth authorization of payment transactions. Issuer tokens act as the essential key in unlocking the authorization process. They establish a secure channel between the tokenized representation and the underlying account, ensuring that payments proceed swiftly and seamlessly, bolstered by a robust layer of protection.

Merchant tokens: simplifying payment processing

Merchant tokens are specific to individual businesses. They are generated by payment processors and linked to a merchant’s account. This tokenization process enables merchants to securely process payments without exposing their customers’ sensitive information. Tailored to the unique identity of each business, merchant tokens serve as a secure conduit for payment processing. Generated and managed by trusted payment processors, they provide a shielded environment for merchants to conduct transactions with confidence, assuring both parties of a secure and seamless payment experience.

The payment token number: decoding its significance

The payment token number is a unique identifier associated with a specific payment token. It allows merchants to distinguish between different transactions and helps ensure accurate processing.

How does tokenization work in payments?

Tokenization replaces sensitive data with unique tokens, reducing the risk of unauthorized access. When a customer initiates a payment, the token is used instead of the actual card information, safeguarding their data throughout the transaction.

Types of payment tokens: exploring varieties

- Network Tokens

- Acquirer Tokens

- Issuer Tokens

- Merchant Token

Payment token crypto: securing transactions

The cryptographic algorithms used in payment tokenization further enhance security. These complex algorithms ensure that even if a token is intercepted, it remains useless to potential attackers.

Payment tokens list: understanding variants

Payment tokens come in various forms, tailored to specific payment processing needs. It’s essential to choose the right type of tokenization for your business to maximize security and efficiency.

Payment tokenization service providers: choosing the right partner

Selecting a reliable payment tokenization service provider is crucial for seamless integration and optimal security. Look for providers with a proven track record in the industry and providers that will give you the flexibility to work with multiple PSP simultaineously, importing and exporting your customers payment data safely, as you whish.

Payment tokenization use cases: beyond transactions

Payment tokenization extends beyond standard transactions. It can be applied to various scenarios, including recurring payments, subscription services, and mobile wallets, revolutionizing the way businesses handle payments.

In conclusion, payment tokens are a fundamental aspect of modern payment processing, offering enhanced security and efficiency for businesses of all sizes. By understanding the different types of tokens and their applications, small and medium business owners can take significant strides towards optimizing their payment systems.

Elevating payment security with gr4vy

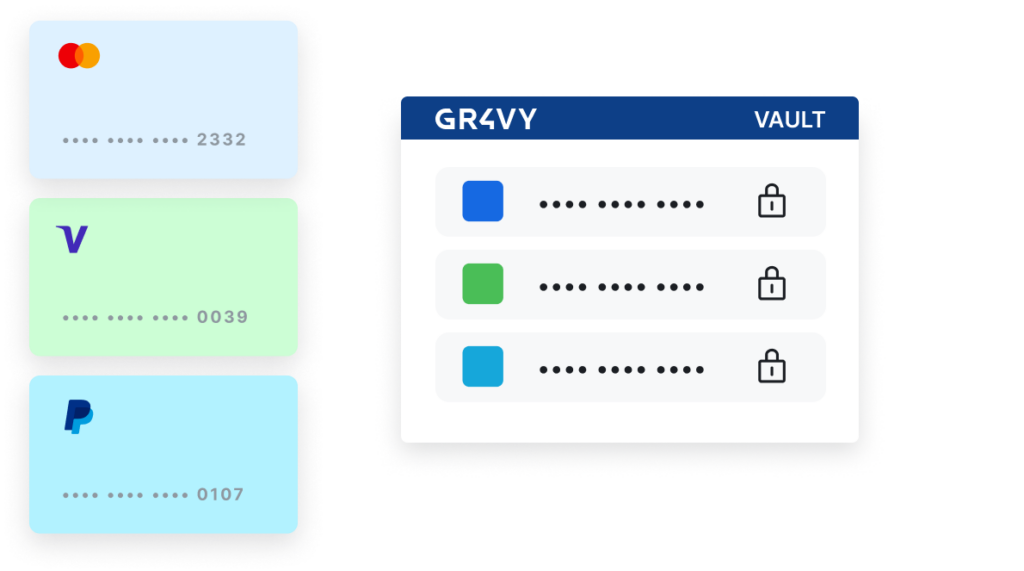

In the pursuit of fortifying payment security and ensure flexibility, businesses can turn to Gr4vy—a leading solution in the field. Gr4vy’s centralized vault gives you the freedom to move around and work with multiple payment providers while allowing you to securely and intelligently collect and store card data, simplifying the burden of PCI DSS compliance.

Gr4vy supports tokenization, storage of all recurrent APMs, a network tokenization solution that centralizes the storage of your network tokens allowing you to use them interoperably between PSPs. With the Gr4vy Cloud Vault you can enable one-click checkout experiences, collect and store card data and use network tokens to tokenize transactions.