April 25, 2025

Top 7 features every payment orchestration platform should have in 2025

- 1. Multi-provider flexibility without added complexity

- 2. Built-in vaulting and tokenization that actually travels with you

- 3. Unified checkout across providers and methods

- 4. Real-time payment intelligence that drives decisions

- 5. Secure by design—and ready for global compliance

- 6. Fraud and risk integrations that adapt to your needs

- 7. Ready for what’s next: APIs, tokens, and open banking

- Choosing orchestration that scales with you

Payments have evolved from a backend necessity to a strategic advantage. In 2025, businesses aren’t just looking for ways to accept payments—they’re searching for ways to manage, optimize, and future-proof their entire payment stack. That’s where payment orchestration platforms come in.

But with dozens of providers entering the space, not every solution is created equal. What truly separates a flexible, enterprise-grade orchestration platform from a patchwork workaround? Let’s break down the features that matter most—and why they should be on your radar if you’re aiming for global growth, smarter payments, and full-stack control.

To learn the basics first, explore Gr4vy’s guide to payment orchestration.

1. Multi-provider flexibility without added complexity

Your customers are everywhere—and your payments should be too. A robust orchestration platform must support multiple PSPs, APMs, and payment flows without multiplying the engineering burden.

Beyond simple aggregation, look for:

- Dynamic routing rules based on geography, card type, currency, or even metadata

- Support for parallel failovers to prevent lost revenue

- A no-code UI that lets your team deploy new payment methods without touching code

With this in place, you’re not locked into any one provider. You’re free to optimize for performance, cost, and coverage, all while maintaining a consistent checkout experience.

Gr4vy supports over 100 integrations across gateways and services, helping you stay connected globally.

2. Built-in vaulting and tokenization that actually travels with you

It’s not enough to store cards. Your orchestration layer should empower data portability—the ability to move between PSPs without recapturing or compromising sensitive cardholder data.

Modern orchestration platforms should include:

- A PCI DSS Level 1-compliant vault

- Support for network tokenization and card updater tools

- Token portability across providers to reduce vendor lock-in

Gr4vy’s cloud vault and tokenization services give merchants full control over their data while meeting regional and industry standards.

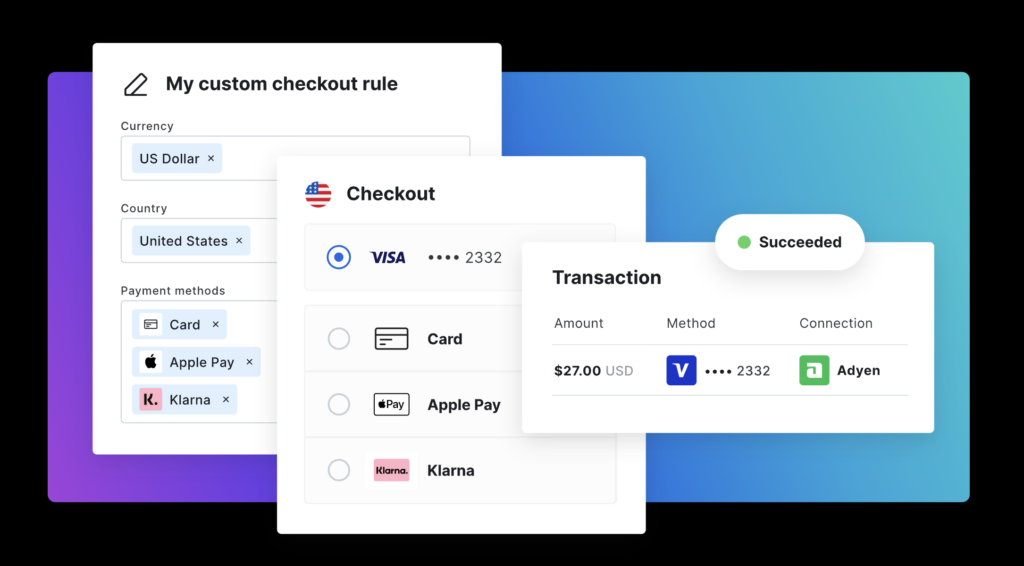

3. Unified checkout across providers and methods

Customers don’t see PSPs—they see your brand. So whether they’re paying with Apple Pay in California or Klarna in Berlin, the experience should be fast, intuitive, and familiar.

An orchestration platform should:

- Unify cards, wallets, BNPL, and local methods under one interface

- Dynamically surface the most relevant options based on location or basket size

- Offer hosted or headless checkout options to fit your stack

By simplifying the front end while managing provider complexity in the background, you improve conversion and reduce maintenance.

4. Real-time payment intelligence that drives decisions

Without visibility, there’s no optimization. A payment orchestration platform should offer real-time data across your entire payment stack.

Look for:

- Transaction-level reporting, including authorization rates, declines, and retry logic

- Provider performance benchmarking

- Dashboards that serve both technical and commercial teams

Combined with smart routing logic, these insights can directly impact revenue and user experience.

To explore how this connects to performance, see why authorization rates matter.

5. Secure by design—and ready for global compliance

In 2025, compliance isn’t just a checkbox—it’s a market entry requirement. Your orchestration partner should help you stay ahead of regulatory needs, not just respond to them.

Expect features like:

- PCI DSS Level 1 certification

- Support for 3D Secure 2, Strong Customer Authentication (SCA), and MFA

- Role-based access control and audit logs

- Region-specific compliance coverage like GDPR, CDR, and PSD2

Gr4vy’s infrastructure is built with global scalability and security at its core, reducing risk while accelerating go-to-market strategies.

6. Fraud and risk integrations that adapt to your needs

Fraud isn’t static—and your defense shouldn’t be either. A capable orchestration platform should integrate easily with your preferred tools, or let you plug in new ones as needs evolve.

Top features include:

- Rule-based routing that adapts based on transaction risk

- API-ready fraud tool compatibility (Sift, Ekata, custom models)

- Support for velocity checks and pre-checkout risk analysis

Orchestration should enhance—not replace—your fraud prevention strategy.

7. Ready for what’s next: APIs, tokens, and open banking

Payments move fast. Your orchestration platform should move faster.

Key capabilities:

- Modular, headless architecture

- Easy integration with modern commerce stacks and platforms

- Support for upcoming trends like account-to-account payments, RTP, and variable recurring payments

Curious about recurring models? Check out this deep dive on VRPs.

Choosing orchestration that scales with you

The best orchestration platform doesn’t just help you manage payments—it helps you grow smarter.

From expanding into new regions to improving checkout speed and approval rates, the right features make the difference between reactive payments and proactive performance.

If you’re exploring orchestration, focus on adaptability, transparency, and full-stack flexibility. Because in 2025, control over your payment stack isn’t just a technical advantage—it’s a business one.

Want to see how orchestration can work for you? Talk to a payments expert at Gr4vy and find out how we help merchants own their payment strategy.