October 8, 2024

What is the difference between payment orchestration and a PSP?

- What is a Payment Service Provider (PSP)?

- What is a Payment Orchestration Platform?

- Key differences between payment orchestration and PSPs

- How do PSPs and Payment Orchestration differ in practice?

- Is a PSP the same as a Payment Gateway?

- Comparison of Payment Gateway and PSP

- What is the difference between PSP and Payment Aggregator?

- What is the difference between Payment Gateway and Payment Orchestration?

- How many types of Payment Gateways are there?

- Trends in Payment Orchestration and PSPs

- FAQs on Payment Orchestration and PSPs

As companies compete to offer seamless online payment experiences, they face a pivotal choice: Payment Service Providers (PSPs) or Payment Orchestration Platforms. These two solutions play essential roles in supporting transactions and securing payment flows, yet they serve distinct purposes that align with different business needs.

Whether aiming for simplicity or needing advanced control, businesses must consider factors like provider flexibility, transaction routing, and global compatibility to choose the right payment strategy. In 2024, the choice between PSPs and payment orchestration platforms is more relevant than ever, as businesses expand globally and customers demand more payment options.

This guide will explore PSPs and payment orchestration platforms, breaking down the advantages, features, and key differences of each solution to help you make an informed decision for your business. We’ll cover industry-related concepts like payment gateways, aggregators, and acquirers, and provide insights into the latest trends shaping the payments industry this year.

What is a Payment Service Provider (PSP)?

A Payment Service Provider (PSP) is a third-party entity that enables merchants to process online transactions by providing a connection to payment networks, such as credit cards, debit cards, and digital wallets. PSPs simplify the complexities of handling payments, from authorizing credit cards to complying with regulatory requirements like PCI DSS.

Key Features of a PSP

- Payment Processing: A PSP handles the end-to-end processing of transactions, including card authorization, capture, and settlement, ensuring that the funds are moved from the customer’s account to the merchant’s account seamlessly.

- Security and Compliance: Most PSPs manage compliance with PCI DSS standards, ensuring that payment data is handled securely, which minimizes risks and the burden of compliance for businesses.

- Fraud Detection and Prevention: Many PSPs offer fraud detection tools that analyze transactions for suspicious patterns, helping prevent fraudulent charges.

- Integration Support: PSPs often provide APIs, plugins, and SDKs to streamline integration with e-commerce platforms, shopping carts, and business websites, allowing merchants to go live quickly.

Examples of Popular PSPs

- Stripe: Known for developer-friendly integration, Stripe offers robust fraud prevention and support for multiple payment methods, including card payments, BNPL, and cryptocurrency.

- PayPal: A well-known PSP that supports credit card, debit card, and PayPal payments, favored by small to medium-sized businesses for its ease of use.

- Adyen: Adyen is a global PSP with a strong focus on high-volume enterprises, offering multi-currency processing, in-depth analytics, and fraud management.

Advantages of Using a PSP

- Simplified Setup: PSPs reduce the complexities of setting up a payment infrastructure by providing all the necessary components under a single account.

- Cost Efficiency: PSPs are cost-effective for smaller businesses, as they offer bundled services and typically charge a straightforward transaction fee.

- Time Savings: Businesses can quickly integrate a PSP and begin accepting payments without having to manage separate relationships with multiple banks or gateways.

Trend: Demand for All-in-One PSP Solutions

The popularity of PSPs continues to grow as they expand their range of supported payment methods. Today’s consumers expect businesses to offer options like buy-now-pay-later (BNPL), mobile wallets, and cryptocurrency payments, and PSPs are meeting these needs by offering seamless access to these payment types in one package. This trend is particularly important for small and mid-sized businesses, which may not have the resources to negotiate with multiple providers independently.

Explore how payment orchestration optimizes payment processing in What Is Payment Orchestration? All You Need to Know in 2024.

What is a Payment Orchestration Platform?

A Payment Orchestration Platform is a comprehensive solution that goes beyond the typical services of a PSP by enabling businesses to manage multiple payment providers and gateways through a single, unified integration. Unlike traditional PSPs, which often focus on providing a single pipeline for transactions, payment orchestration platforms are designed to work with multiple providers and dynamically route transactions to optimize costs, improve transaction success rates, and ensure failover in case of disruptions. This flexibility makes them particularly attractive for businesses with complex or high-volume payment needs, especially in global e-commerce and multi-region operations.

Key features of Payment Orchestration

- Multi-Provider Integration: Payment orchestration platforms allow businesses to connect to multiple PSPs and gateways simultaneously, creating redundancy in payment processing and allowing merchants to select providers based on their specific needs.

- Dynamic Transaction Routing: Smart routing features enable the platform to send transactions through the most suitable provider or gateway, optimizing for factors like location, transaction success rate, fees, and compliance requirements. This flexibility improves transaction success rates by dynamically adjusting to the best-performing route.

- Failover Management: By automatically rerouting transactions if one provider experiences downtime, payment orchestration ensures that businesses can maintain a consistent and reliable payment experience for customers. This capability is crucial for high-volume businesses that cannot afford disruptions.

- Consolidated Reporting and Analytics: Payment orchestration platforms centralize transaction data across all providers, offering businesses a complete view of their payment ecosystem. These analytics can reveal insights into customer behavior, transaction success rates, and fraud patterns, helping businesses make data-driven decisions to improve their payment processes.

- Enhanced Security and Compliance: Many orchestration platforms offer advanced security measures, such as tokenization and encryption, to protect payment data. They also simplify compliance with global standards, such as PCI DSS and local data protection laws.

Advantages of using a payment orchestration platform

- Improved Flexibility and Customization: Businesses have full control over the selection and routing of payment providers, allowing them to tailor the payment process to match customer preferences and regional requirements.

- Cost Savings: By optimizing routing based on transaction fees, payment orchestration platforms can help reduce transaction costs, particularly for international payments where fees can vary significantly across providers.

- Scalability for Growth: Payment orchestration platforms make it easier for businesses to expand globally by offering support for local payment providers, currencies, and regulatory compliance, all of which are critical when entering new markets.

Trend: The rise of payment orchestration for flexibility

With the acceleration of cross-border e-commerce, payment orchestration platforms are becoming indispensable for businesses seeking to offer localized payment methods without being locked into a single provider. These platforms help companies maintain high approval rates, lower fees, and ensure compliance with local regulations across different regions.

Key differences between payment orchestration and PSPs

While both PSPs and payment orchestration platforms enable online transactions, they serve different purposes and offer unique features. Let’s break down the core differences between the two options:

| Feature | Payment Service Provider (PSP) | Payment Orchestration Platform |

| Provider Flexibility | Limited to one provider | Supports multiple PSPs and gateways |

| Transaction Routing | Fixed, with no or minimal routing | Dynamic routing to optimize cost and success rates |

| Failover Capabilities | Relies on a single provider’s uptime | Backup routing reduces transaction failures |

| Data Consolidation | Basic, limited to one PSP’s reports | Centralized data and reporting from multiple sources |

| Customization Options | Basic control over branding | Full control over routing, security, and UX |

| Scalability | Dependent on one provider’s services | Scalable across multiple regions and providers |

| Security and Compliance | Managed by the single PSP | Centralized compliance, tokenization, and encryption |

| Customer Experience Control | Limited, single provider UX | Enhanced experience through custom routing |

How do PSPs and Payment Orchestration differ in practice?

Understanding how PSPs and payment orchestration platforms work in real-world scenarios can clarify the practical benefits and limitations of each. Below, we’ll explore specific use cases where PSPs or payment orchestration platforms offer unique advantages.

- Flexibility in Provider Selection

- PSP: Ideal for small to medium-sized businesses that need an all-in-one solution without the complexity of managing multiple providers. These businesses may prioritize ease of setup and cost-effectiveness over advanced routing or failover capabilities.

- Payment Orchestration: Suited for enterprises with complex payment needs, such as cross-border e-commerce sites that must cater to different regional providers. For instance, an online retailer operating in North America, Europe, and Asia could leverage payment orchestration to route transactions through local PSPs, reducing costs and enhancing approval rates.

- Advanced Routing and Failover

- PSP: Limited in its ability to manage failed transactions due to reliance on a single provider. If a transaction fails, there may be no backup provider to reroute it, potentially resulting in lost revenue.

- Payment Orchestration: Smart routing and failover capabilities mean that if one provider experiences issues, the platform automatically reroutes transactions to another provider. This results in higher transaction success rates, especially important for businesses with high transaction volumes, where even a small percentage of failed transactions can lead to substantial losses.

- Enhanced Reporting and Data Consolidation

- PSP: Provides reports only from a single provider, limiting insights to what that provider offers.

- Payment Orchestration: Aggregates data across multiple PSPs, giving businesses a complete view of payment performance across different markets, providers, and currencies. This data allows businesses to optimize their payment flow, adjust routing strategies, and monitor trends in real time.

Real-World application example

Consider an e-commerce business expanding to Europe, where they encounter local regulations and regional payment preferences. Using a payment orchestration platform, the business could integrate with local PSPs in European countries, offering preferred local payment methods while ensuring compliance with the EU’s General Data Protection Regulation (GDPR). This would enhance customer experience and optimize transaction costs, creating a smooth and profitable expansion process.

Is a PSP the same as a Payment Gateway?

While PSPs and payment gateways are both integral to processing online payments, they serve distinct roles within the payment ecosystem. Understanding the differences can help businesses identify the components necessary for their payment infrastructure.

- Payment Gateway: A payment gateway is a technology that facilitates the authorization of credit card payments by securely transmitting data between the merchant’s website and the acquiring bank. It acts as an intermediary, ensuring that sensitive payment data, such as card numbers and personal information, is encrypted and securely passed from the customer to the bank. However, the gateway itself doesn’t settle or process payments; it merely facilitates authorization and secure transmission.

- Payment Service Provider (PSP): A PSP often includes a payment gateway as part of its offering but also provides additional services, such as transaction processing, fraud detection, and support for alternative payment methods. PSPs manage the entire payment lifecycle from authorization through settlement, providing a more comprehensive solution than a standalone gateway.

Comparison of Payment Gateway and PSP

| Function | Payment Gateway | Payment Service Provider (PSP) |

| Primary Role | Authorizes transactions | Processes entire transaction lifecycle |

| Security and Compliance | Secure transmission of data only | Ensures end-to-end security and PCI DSS compliance |

| Fraud Detection | Basic fraud prevention | Advanced fraud detection tools |

| Settlement and Reconciliation | No settlement capabilities | Manages settlement, reconciliation, and reporting |

| Integration Scope | Standalone integration | Typically bundles gateway with other services |

In short: A payment gateway handles transaction authorization and secure transmission of data, whereas a PSP provides a full-service solution covering everything from authorization to settlement and security compliance.

What is the difference between PSP and Payment Aggregator?

Payment Aggregators and PSPs both facilitate the processing of online payments, but they differ primarily in terms of account setup and customer base:

- Payment Aggregator: A payment aggregator pools multiple merchants under a single account, allowing smaller merchants to accept payments without having to open their own merchant accounts. This model is often more cost-effective and quicker to set up than traditional PSP accounts, as it eliminates the need for individual merchant accounts. However, sharing a merchant account across multiple businesses can lead to increased risk of fraud, and some merchants may face additional challenges in customizing their payment setup.

- Traditional PSP: A PSP offers individual merchant accounts, providing merchants with more control and reducing the risk of chargebacks due to pooled accounts. PSPs offer additional services like advanced reporting, customization options, and direct control over account settings.

When to use each solution

- Payment Aggregator: Ideal for smaller businesses, startups, or freelancers who need a cost-effective solution with a quick setup and minimal requirements for customization.

- Traditional PSP: More suitable for mid-sized to large businesses that require individual accounts, in-depth reporting, and advanced customization options.

What is the difference between Payment Gateway and Payment Orchestration?

Both payment gateways and payment orchestration platforms are involved in processing payments, but they play different roles within the payment process.

- Payment Gateway: A payment gateway is primarily responsible for authorizing transactions by securely transmitting payment data between the merchant, the acquirer, and the issuing bank. The gateway facilitates the initial steps of a transaction, verifying the validity of the payment method and ensuring that customer data is securely encrypted and transmitted. However, gateways are generally limited to one provider and don’t offer dynamic routing or failover management.

- Payment Orchestration Platform: A payment orchestration platform manages multiple gateways, PSPs, and acquirers, enabling businesses to build a flexible payment infrastructure. Orchestration platforms provide additional capabilities, such as smart routing, failover management, consolidated reporting, and customizable workflows. They allow businesses to choose the best-performing route for each transaction, ensuring higher approval rates, reducing fees, and providing a seamless experience for customers across multiple regions.

Summary of differences

| Feature | Payment Gateway | Payment Orchestration Platform |

| Function | Authorizes and transmits transaction data | Manages multiple gateways and PSPs |

| Routing | No routing capabilities | Smart routing for cost efficiency and higher approval rates |

| Failover Management | Limited to single provider, no failover | Reduces transaction failures with backup routing |

| Data and Reporting | Basic transaction data only | Centralized reporting from multiple sources |

| Customization | Limited to gateway-specific settings | High level of customization, control over workflows |

In brief: Payment gateways handle transaction authorization and data security, while payment orchestration platforms manage complex payment setups with features like dynamic routing, failover, and consolidated data analytics.

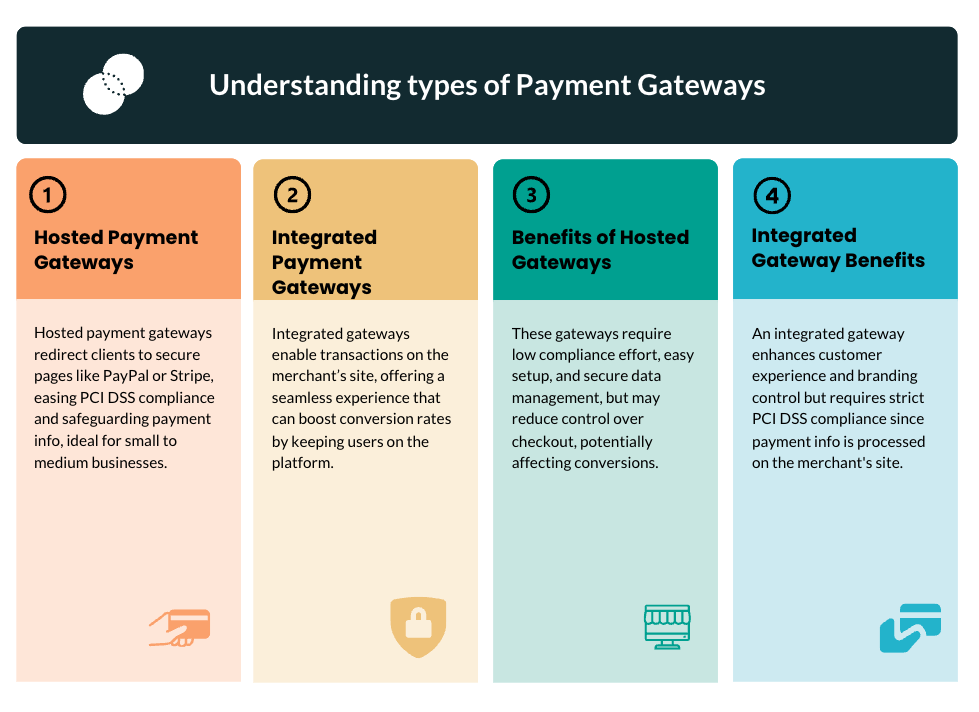

How many types of Payment Gateways are there?

Payment gateways are broadly categorized based on their integration style and user experience, with two main types commonly used:

- Hosted Payment Gateways: Hosted gateways redirect customers to an external payment page (such as PayPal or Stripe Checkout) where the payment provider manages the transaction and secures the payment information. This model is popular for small to medium businesses as it reduces PCI DSS compliance requirements and limits the merchant’s exposure to sensitive payment data.

- Advantages: Low compliance burden, quick to set up, and secure as the payment provider handles the sensitive data.

- Disadvantages: Less control over the checkout experience, as customers are redirected to another page, potentially impacting conversion rates.

- Integrated Payment Gateways: Integrated gateways, also known as on-site gateways, allow customers to complete the payment process within the merchant’s website or app. They offer a seamless experience and keep customers on the merchant’s platform, which can increase conversion rates.

- Advantages: Enhanced customer experience and greater control over branding.

- Disadvantages: Requires more stringent compliance with PCI DSS standards, as sensitive payment data is handled directly on the merchant’s website.

Trends in Payment Orchestration and PSPs

The payments industry is evolving rapidly, with customer expectations, technological advancements, and regulatory changes driving new trends. Here’s a look at some of the key trends for 2024 that are influencing the adoption and features of Payment Orchestration Platforms and PSPs:

1. Increased Demand for Alternative Payment Methods

- With the rise of alternative payment methods (APMs), including buy-now-pay-later (BNPL), digital wallets, and cryptocurrencies, consumers expect more options at checkout. In 2024, both PSPs and orchestration platforms are expected to expand their support for these payment methods. Businesses that cater to international customers especially benefit from offering local payment methods, as preferences can vary significantly by region.

- Implications for PSPs and Orchestration: PSPs are integrating with more APMs to remain competitive. Meanwhile, payment orchestration platforms allow businesses to manage a range of APMs, switching easily between providers based on regional demand and optimizing transaction success rates.

2. AI-Driven Fraud Detection and Prevention

- Fraud detection is an essential part of payment processing, with AI-powered tools becoming more sophisticated in identifying and preventing fraudulent transactions. In 2024, payment orchestration platforms are leveraging AI to analyze transaction data across multiple PSPs and gateways, spotting unusual patterns and implementing real-time prevention measures.

- Implications for PSPs and Orchestration: PSPs are enhancing their fraud detection capabilities to retain customers, but orchestration platforms have a unique advantage, as they can detect fraud patterns across a wider ecosystem of providers. This cross-platform monitoring provides an additional layer of security for high-risk businesses.

3. Enhanced Data Privacy and Global Compliance

- Data privacy is a top priority, especially as regulations like GDPR (Europe) and CCPA (California) set high standards for handling customer data. In 2024, payment orchestration platforms are focusing on tools that help businesses manage and comply with data privacy regulations across multiple jurisdictions. Compliance with PCI DSS and local privacy laws is built into orchestration platforms, reducing the burden on businesses.

- Implications for PSPs and Orchestration: PSPs generally manage compliance within their own ecosystems. However, businesses using payment orchestration platforms benefit from centralized compliance management, which reduces complexity when expanding into new markets with unique regulatory requirements.

4. Increased Focus on Smart Routing and Cost Optimization

- Cost savings are a significant driver for payment orchestration, with businesses looking to optimize transactions by routing payments through the most cost-effective providers. Smart routing can reduce transaction costs and improve approval rates, especially for international payments. This trend is accelerating as businesses prioritize customer experience while also seeking to maximize profitability.

- Implications for PSPs and Orchestration: While some PSPs offer regional cost optimization, payment orchestration platforms excel by routing transactions based on various factors, such as cost, region, and provider performance. This approach offers greater savings and enhanced control over transaction routing.

Boost your approval rates with expert insights in How to Optimize Approval Rates.

FAQs on Payment Orchestration and PSPs

Here’s a quick look at some frequently asked questions related to payment orchestration platforms and PSPs, aimed at helping businesses understand these solutions better:

Is payment orchestration only for large businesses?

- No, while payment orchestration platforms offer advanced capabilities suitable for large enterprises, they can also benefit small businesses that want to reduce transaction costs and improve payment success rates. Even businesses with moderate transaction volumes can leverage payment orchestration to optimize routing and failover.

Can I use a payment gateway without a PSP?

- Yes, some businesses use standalone payment gateways and work directly with acquirers to manage transactions. However, many companies find PSPs more convenient as they bundle gateway services with other essential features, such as compliance management and fraud prevention.

How does payment orchestration improve transaction approval rates?

- Payment orchestration platforms use smart routing to direct transactions through the best-performing provider based on success rates and other criteria. This dynamic routing minimizes declines and improves overall approval rates.

Are white-label PSPs available for businesses wanting a branded payment solution?

- Yes, many PSPs offer white-label solutions, allowing businesses to integrate a fully branded payment experience into their websites or apps without the need to build a payment infrastructure from scratch.

What’s the advantage of payment orchestration over a single PSP?

- Payment orchestration offers flexibility, cost savings, and failover management by supporting multiple PSPs. This is something a single PSP cannot provide, as orchestration allows businesses to adjust routing and provider selection based on performance and cost.

Choosing between a PSP and a payment orchestration platform depends on the specific needs, size, and growth goals of a business. For smaller businesses or those with simpler payment requirements, a PSP provides a streamlined, easy-to-integrate solution that covers payment processing, fraud prevention, and compliance. However, a payment orchestration platform offers advanced flexibility, scalability, and optimization for companies with larger transaction volumes, global customers, or complex payment needs.

By using a payment orchestration platform, businesses gain full control over their payment processes, enabling them to provide an exceptional customer experience and maximize transaction success rates. In 2024, the choice between these solutions is no longer just about convenience but about strategy, scalability, and meeting customer expectations in an evolving digital economy.

Ready to streamline and optimize your payment process? Contact Gr4vy to learn more about our comprehensive payment orchestration platform and discover how it can support your payment strategy.