March 14, 2024

What is payment orchestration? All you need to know in 2024

- Key Components of Payment Orchestration:

- Payment orchestration examples

- What are the advantages of payment orchestration?

- The payment orchestration process

- What is the difference between a payment gateway and a payment orchestration platform?

- What is orchestration in finance?

- What is transaction orchestration?

- What is the overview of the payments orchestration market?

- Gr4vy’s approach to Payment Orchestration

With online retail sales expected to hit $9.4 trillion by 2026, businesses are facing an unprecedented opportunity for growth. However, capturing a share of this market isn’t just about offering fantastic products or services; it’s also about how efficiently you can handle digital payments. This is where payment orchestration is critical for any business looking to streamline their payment processes and enhance customer satisfaction at checkout.

This guide introduces you to payment orchestration, explaining how it differs from traditional payment gateways and why it’s essential for managing transactions more effectively. We’ll dive into the practical benefits of adopting a payment orchestration platform, from simplifying integrations to expanding your global reach and providing a seamless payment experience for your customers.

How does payment orchestration work?

Payment orchestration integrates and manages the entire end-to-end payment process to streamline and optimize transactions for e-commerce businesses. This process involves several key steps and components that enhance online payments’ efficiency, security, and versatility. Here’s a detailed breakdown of how payment orchestration works:

Customer checkout experience

A customer adds a product or service to their shopping cart on an e-commerce website and proceeds to checkout.

The customer selects a payment method and inputs their payment details into the payment gateway provided on the website.

Payment gateway encryption

The payment gateway encrypts the customer’s payment card information to ensure secure data transmission over the Internet.

This encrypted information is sent to the acquiring bank through the payment processor.

Transaction authorization

Upon receiving the payment details, the acquiring bank communicates with the customer’s issuing bank to verify the transaction details and ensure sufficient funds or credit is available.

The issuing bank then sends an authorization (approval) or a decline response to the acquiring bank.

Automated transaction touting (Smart Routing)

In traditional payment setups, if a payment fails, it typically ends the transaction attempt. However, payment orchestration platforms use smart routing to redirect failed payments to an alternative payment processor, minimizing the chances of false declines.

This rerouting is based on predefined criteria to select the best alternative processor, optimizing for success rate, cost efficiency, or other factors important to the merchant.

Transaction approval and settlement

The transaction is approved if the alternate payment processor successfully authorizes the rerouted payment.

The acquiring bank returns the authorization response to the payment gateway, which then communicates it to the merchant and the customer, completing the transaction.

The funds are later settled between the banks, and the transaction amount is transferred to the merchant’s account.

Key Components of Payment Orchestration:

Payment gateway: Interfaces with the customer for payment data entry and initiates transactions.

Payment processor: Facilitates the transaction by transmitting data between the merchant, acquiring bank, and issuing bank.

Acquiring bank: The merchant’s bank that receives payment authorizations and settlements.

Issuing bank: The customer’s bank that issues the credit or debit card and authorizes transactions.

By effectively managing these components and processes, payment orchestration platforms enable e-commerce businesses to offer a seamless payment experience to customers, support multiple payment methods and currencies, and improve overall transaction success rates. This leads to enhanced customer satisfaction, increased revenue, and the ability to scale and enter new markets more easily.

Payment orchestration examples

Payment orchestration can be implemented in various ways, depending on the specific needs and objectives of an e-commerce business. Below are examples that illustrate how payment orchestration can be applied in different scenarios, showcasing its flexibility and wide range of benefits:

Global e-commerce expansion

An online retailer in the United States wants to expand its market to Europe and Asia. Using a payment orchestration platform, the retailer integrates multiple popular payment service providers (PSPs) in these regions, such as Alipay in China, Giropay in Germany, and others, without needing separate integrations with each PSP. This simplifies the payment process and ensures customers in these new markets can pay using their preferred payment methods, significantly boosting conversion rates and customer satisfaction.

Subscription-based services

A subscription-based video streaming service operates worldwide and faces challenges with recurring payments, such as high decline rates and customer churn. The service can automatically route regular payments through different PSPs based on success rates by implementing a payment orchestration platform, minimizing declines. Additionally, the platform can handle payment method updates and retries failed transactions, reducing churn and improving revenue retention.

High-volume online marketplaces

An online marketplace connecting thousands of sellers and buyers globally must manage a complex payment ecosystem. Payment orchestration allows for the seamless distribution of payments to sellers, handling of refunds, and support for multiple currencies and payment methods. Smart routing ensures transactions are processed through the most cost-effective and reliable channels, enhancing efficiency and user satisfaction.

Cross-Border online retail

An ecommerce company selling luxury goods wants to reduce the costs associated with cross-border payments and improve acceptance rates for international customers. By leveraging a payment orchestration platform, the company routes transactions through local payment processors in the customer’s country, reducing transaction fees and improving success rates due to local compliance and currency matching. This approach also enables offering localized payment options, such as BNPL (Buy Now, Pay Later) services, enhancing the customer’s checkout experience.

Mobile and in-app purchases

A mobile gaming company seeks to optimize in-app purchases across various platforms and countries. Through payment orchestration, the company integrates several PSPs and mobile wallet options within the app, offering players the flexibility to choose their preferred payment method. Dynamic routing and automatic retries for failed transactions reduce disruptions and abandonment, improving conversion rates and overall revenue from in-app purchases.

Event ticketing platform

An event ticketing platform operating in multiple countries uses payment orchestration to handle peak sales periods efficiently, such as during major event launches or promotions. The platform uses automated transaction routing to manage the high volume of transactions, distributing the load across multiple PSPs to avoid system overloads and ensure high availability and fast processing times, resulting in a smooth customer purchasing experience.

These examples illustrate the versatility of payment orchestration in addressing diverse ecommerce challenges, from global expansion and currency conversion to improving transaction success rates and customer experience. Businesses can significantly enhance their operational efficiency and competitiveness in the global market by leveraging a single, integrated platform to manage multiple payment processors and methods.

The benefits of a payment orchestration platform

A Payments Orchestration Platform offers a comprehensive solution for businesses looking to optimize their online payment processes. By integrating various payment services and methods into a unified system, these platforms deliver several critical benefits that can significantly enhance operational efficiency, customer experience, and financial performance. Here are the key benefits of implementing a Payments Orchestration Platform:

1. Increased revenue

- Simplifies the payment process, improving the customer experience and reducing cart abandonment.

- Expands global reach by enabling businesses to accept a wide variety of payment types, including local and alternative payment methods, which can lead to higher conversion rates and more sales.

- Supports advanced payment options like Buy Now, Pay Later (BNPL) and subscription models, further boosting customer conversion and retention.

2. Reduced processing costs

- Automates the payment process, reducing manual efforts and operational costs.

- Routes transactions through the most cost-effective channels, minimizing transaction fees and processing costs.

- Integrating multiple options enables better negotiation leverage with payment service providers, potentially lowering fees.

3. Enhanced customer experience

- Offers customers a broad selection of payment options, increasing convenience and satisfaction.

- Reduces payment failures and improves transaction success rates through smart routing and automatic retries, leading to a smoother checkout process.

- Ensures a seamless payment experience across all channels and platforms, catering to the preferences of diverse customer bases.

4. Improved security and compliance

- Centralizes the management of payment services, ensuring consistent application of security measures across all payment methods and providers.

- Facilitates compliance with international payment standards and regulations, such as PCI DSS, GDPR, and others, reducing the risk of data breaches and non-compliance penalties.

5. Real-Time analytics and reporting

- Provides comprehensive insights into payment transactions, trends, and customer behaviors, enabling data-driven decision-making.

- Simplifies reconciliation and reporting processes by aggregating data across multiple payment providers in a single platform.

- Helps identify and address inefficiencies, optimize payment strategies, and uncover new growth opportunities.

6. Scalability and flexibility

- Easily adapts to changing business needs, allowing for quick addition or removal of payment providers and methods.

- Supports scalability by efficiently handling increasing volumes of transactions without significant changes to the existing infrastructure.

- Enables businesses to easily enter new markets by integrating local payment solutions and accommodating various currencies.

7. Simplified integration and maintenance

- Reduces the complexity of integrating multiple payment services by providing a single API that connects to numerous payment processors and gateways.

- Minimizes maintenance efforts as the orchestration platform manages updates and enhancements to payment services, ensuring that businesses always have access to the latest features and capabilities.

8. Dynamic payment routing

- Increases transaction approval rates by intelligently routing transactions to the best-suited payment provider based on predefined rules and criteria.

- Reduces the impact of service downtimes and declines by automatically rerouting transactions to alternative providers, ensuring uninterrupted payment processing.

In summary, a Payments Orchestration Platform is a powerful tool for businesses aiming to optimize their payment processes. It enhances operational efficiency and customer satisfaction, increases revenue, and strengthens the company’s competitive edge in the global market.

What are the advantages of payment orchestration?

Payment orchestration offers many advantages for businesses navigating the complexities of modern e-commerce and digital transactions. By streamlining and optimizing the payment process through a centralized platform, companies can achieve operational efficiency, improved customer experiences, and financial growth. Here are the key advantages of payment orchestration:

1. Enhanced customer experience

- Provides a seamless, frictionless payment process for customers by offering a variety of payment methods and currencies, catering to global preferences, and increasing the likelihood of purchase completion.

- Minimizes transaction failures and enhances success rates through intelligent routing and automatic retries, reducing customer frustration and abandoned transactions.

2. Increased conversion rates

- Reduces cart abandonment by simplifying the checkout process and offering preferred local payment options, leading to higher conversion rates and increased sales.

3. Global market expansion

- Facilitates entry into new markets by enabling businesses to easily integrate local payment methods and comply with regional regulations, thus reaching a wider customer base.

- Supports multiple currencies and languages, making it easier for international customers to shop and complete transactions in their local context.

4. Operational efficiency

- Consolidates multiple payment gateways and processors into a single platform, simplifying the management of payment infrastructure and reducing administrative overhead.

- Automates the payment process, from transaction routing to error handling, reducing the need for manual intervention and increasing operational efficiency.

5. Cost savings

- Optimizes transaction costs by intelligently routing payments to the most cost-effective service providers, reducing processing fees and operational costs.

- Enables better negotiation of rates with payment service providers due to the aggregate volume of transactions routed through the orchestration platform.

6. Improved security and compliance

- Centralizes security and compliance efforts, ensuring that all transactions meet the highest data protection standards and adhere to international regulations such as PCI DSS, GDPR, etc.

- Reduces the risk of fraud through enhanced security measures and monitoring capabilities provided by the orchestration platform.

7. Data insights and analytics

- Offers valuable insights into payment data, customer behavior, and market trends through comprehensive analytics and reporting tools, enabling data-driven decision-making.

- Facilitates the optimization of payment strategies based on real-time performance data, helping businesses continuously improve their payment processes.

8. Scalability and flexibility

- It easily scales with the business’s growth, supporting an increasing number of transactions, payment methods, and markets without requiring significant changes to the existing infrastructure.

- Provides the flexibility to quickly adapt to changing market conditions, customer preferences, or business strategies by adding or removing payment services as needed.

9. Reduction in failed transactions

- Decreases the number of declined transactions by using intelligent routing to select the best payment processor based on success rates, enhancing customer satisfaction and retention.

10. Simplified integration and maintenance

- Streamlines the integration of new payment methods and services through a single interface, reducing development time and resources required to expand payment capabilities.

- Centralizes maintenance and updates, ensuring the payment system remains up-to-date with the latest features and security measures without extensive IT involvement.

By leveraging payment orchestration, businesses can significantly improve their payment operations, enhance customer experiences, and position themselves for growth in the ever-evolving digital marketplace.

The payment orchestration process

The payment orchestration process involves a series of integrated steps and components designed to streamline and enhance the efficiency of online payment transactions. This process simplifies the handling of payments for merchants and optimizes the customer’s checkout experience. Here’s an overview of how the payment orchestration process typically unfolds:

1. Customer checkout

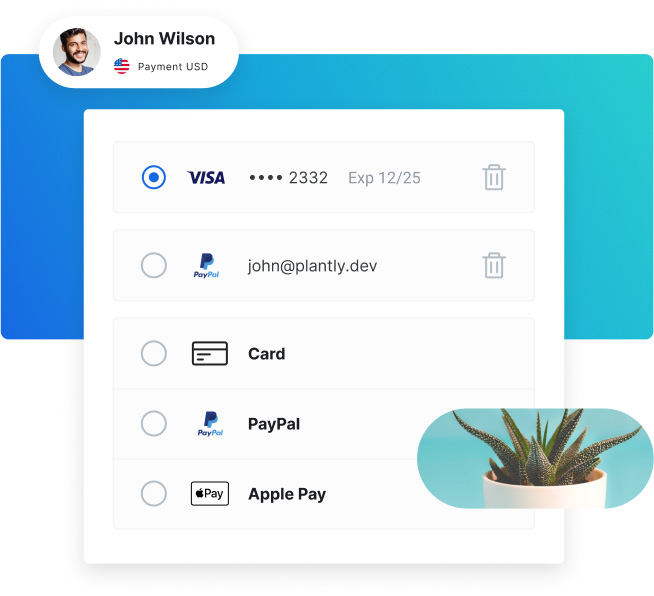

- The process begins when a customer selects products or services and proceeds to the checkout page on an e-commerce platform. At checkout, the customer chooses their preferred payment method from a range of options provided by the payment orchestration platform.

2. Payment method selection

- Upon selecting a payment method, the customer enters their payment details. These details are securely captured by the payment gateway integrated into the orchestration platform.

3. Data encryption and transmission

- The payment gateway encrypts the payment information to ensure secure transmission. It then forwards this encrypted data to the payment orchestration platform.

4. Payment orchestration

- The orchestration platform receives the transaction details and performs several critical functions:

- Routing: It dynamically routes the transaction to the most suitable payment processor based on predefined criteria such as success rates, transaction costs, or the customer’s geographical location.

- Fraud Detection: Concurrently, the transaction undergoes fraud analysis using integrated tools within the orchestration platform to assess the risk level.

5. Transaction processing

- The chosen payment processor submits the transaction to the acquiring bank, which then forwards it to the card networks (Visa, Mastercard, etc.) and ultimately to the issuing bank (the customer’s bank) for authorization.

6. Authorization and response

- The issuing bank approves or declines the transaction based on the customer’s account status and notifies the acquiring bank and payment processor of its decision.

- If the transaction is declined, the payment orchestration platform can automatically attempt to reroute the transaction through another payment processor, enhancing the likelihood of approval.

7. Confirmation and settlement

- Once approved, the transaction is confirmed to the merchant and customer. The funds are then settled between the acquiring bank and the merchant’s bank account, completing the financial transaction.

8. Reporting and analytics

- Throughout this process, the payment orchestration platform collects data on every transaction. Merchants can access this data for real-time analytics, reporting, and insights, enabling them to make informed decisions about their payment strategies.

9. Optimization and adjustment

- Based on the insights gained from analytics, merchants can adjust their payment processing strategies, add or remove payment methods, and optimize transaction routing criteria to improve success rates and reduce costs.

This orchestrated process not only automates and optimizes each payment transaction but also provides a framework for continuous improvement and adaptation to changing market conditions, customer preferences, and technological advancements. By centralizing and managing the complexities of the payment ecosystem, payment orchestration platforms offer a scalable, secure, and efficient solution for ecommerce businesses aiming to enhance their payment operations and customer experience.

FAQ

What is the difference between a payment gateway and a payment orchestration platform?

Payment Gateway is a service that authorizes and processes payments for online and offline businesses. It acts as an intermediary between a merchant’s website and payment processor, securely transmitting payment information from the customer to the merchant’s bank. A payment gateway enables businesses to accept credit card or direct payments.

On the other hand, a payment Orchestration Platform (POP) is a more comprehensive solution that manages the entire payment process across multiple payment gateways and systems. It integrates various payment services, streamlines the transaction process, and optimizes payment operations through intelligent routing, fraud management, and compliance checks. A POP provides a unified interface for handling various payment methods, currencies, and regions, making it easier for businesses to manage their global payment infrastructure.

What is orchestration in finance?

Orchestration in finance refers to coordinating financial transactions and processes across different platforms and systems. It involves automating and optimizing the flow of financial operations to improve efficiency, reduce costs, and enhance the effectiveness of financial services. In payments, this means dynamically selecting the best execution path for transactions, ensuring compliance with regulatory requirements, and providing a seamless payment experience for customers.

What is transaction orchestration?

Transaction orchestration is managing and optimizing a payment transaction’s journey from initiation to completion. This involves coordinating between various payment services, gateways, and processors to ensure the transaction is processed efficiently and successfully. Transaction orchestration looks at factors such as transaction cost, success rate, and customer preference to route payments in a way that enhances the likelihood of approval, minimizes fees, and improves the customer’s checkout experience.

What is the overview of the payments orchestration market?

The payments orchestration market encompasses solutions and platforms that provide centralized management of multiple payment processes and services. This market has seen significant growth due to the increasing complexity of the global payments landscape, the surge in e-commerce, and the need for businesses to offer customers a wide range of payment options across different regions and channels. Key drivers include the demand for improved payment success rates, reduced transaction costs, enhanced security and fraud prevention, and compliance with varying international regulations. The market is characterized by innovation, with providers offering advanced features such as intelligent routing, real-time analytics, and seamless integration of various payment methods and currencies to meet the evolving needs of online merchants and consumers.

Gr4vy’s approach to Payment Orchestration

Gr4vy is a beacon for businesses aiming to increase conversion rates and drive profitability through a tailored payment experience for every customer. By enabling the routing of transactions to your PSP of choice, Gr4vy elevates your strategy beyond the norm. This approach mitigates fraud and chargebacks, fine-tunes processing fees, and slashes transaction costs, laying a solid foundation for financial health and customer satisfaction.

Moreover, Gr4vy’s capabilities extend to ensuring compliance and ethical business practices, notably through its feature to restrict the sale of prohibited goods. This comprehensive suite of features demonstrates Gr4vy’s commitment to providing a robust, adaptable payment orchestration platform. Ready to leverage these benefits for your business? Contact Gr4vy today. Together, we can craft a payment experience that’s efficient, secure, and highly personalized.