December 22, 2023

What is an alternative payment method and how can your business benefit from it

- Description of alternative payment methods

- Benefits of Alternative Payment Methods for Businesses

- What is the alternative to payment?

- What is an alternative method that can be used to make payments?

- Why is payment method important in business?

- Which payment method is best and why?

- What does payment method mean in business?

- Take Control of Your Payment Strategy with Gr4vy

Let’s talk about the changing face of business transactions. It’s an exciting time in the world of commerce, with alternative payment methods (APMs) opening up new possibilities for businesses big and small. This guide is crafted to walk you through these exciting developments in a straightforward and professional manner. Whether you’re a small startup or a well-established enterprise, understanding and leveraging APMs can be a real game changer for your business. So, let’s explore together how these alternative methods can unlock new potentials and drive your business forward.

Description of alternative payment methods

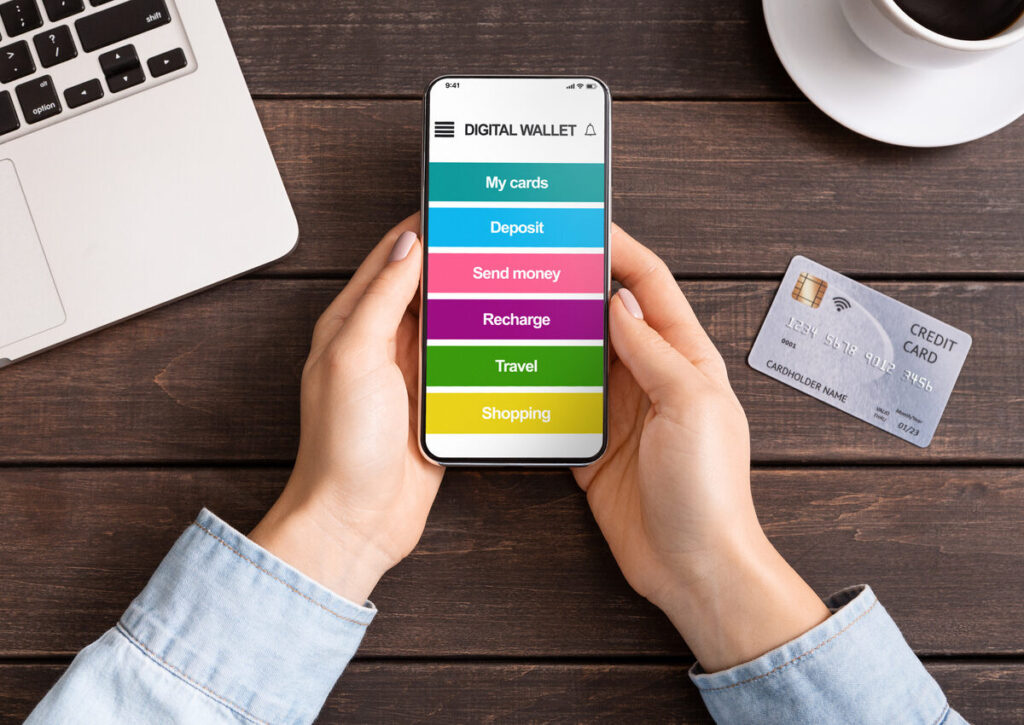

- Digital wallets (e.g., PayPal, Apple Pay, Google Wallet): These are electronic devices or online services that allow individuals to make electronic transactions. Users can link their bank accounts or credit cards to these wallets for seamless transactions.

- Bank transfers (e.g., Wire Transfers, ACH Payments): This method involves the direct transfer of funds from one bank account to another. It’s often used for larger transactions and can be facilitated online or in person at a bank.

- Cryptocurrency (e.g., Bitcoin, Ethereum): Cryptocurrencies are digital or virtual currencies that use cryptography for security. They are decentralized and operate on a technology called blockchain. Transactions are generally secure, fast, and can cross international borders without traditional banking fees.

- Buy now, pay later (BNPL) Services (e.g., Klarna, Afterpay): This method allows consumers to purchase goods immediately and pay for them over time, typically in installments. It’s a form of short-term financing and is becoming increasingly popular in ecommerce.

- Mobile payments (e.g., Venmo, Zelle): These are payments made through mobile devices. They are convenient for peer-to-peer transfers and are increasingly accepted by merchants.

- Prepaid cards: These are cards that are loaded with a set amount of money and can be used like a debit or credit card. They are beneficial for consumers who don’t have bank accounts or prefer not to use their credit or debit cards online.

- E-Invoices: This involves sending an invoice electronically and allowing the customer to pay through various online methods. It’s commonly used in B2B transactions.

- Direct debits: This method allows a business to take payments directly from a customer’s bank account with their permission. It’s commonly used for recurring payments, like subscriptions.

Benefits of Alternative Payment Methods for Businesses

- Wider customer reach: By offering multiple payment options, businesses can cater to a wider audience with diverse payment preferences.

- Enhanced convenience for customers: APMs like digital wallets and mobile payments offer a quick and seamless checkout process, improving customer satisfaction.

- Lower transaction costs: Some APMs, especially direct bank transfers and certain digital wallets, may have lower fees compared to traditional credit card transactions.

- Improved security: Methods like cryptocurrency and digital wallets often incorporate advanced security features, reducing the risk of fraud.

- Access to international markets: APMs facilitate cross-border transactions, making it easier for businesses to expand globally.

- Faster payment processing: Certain APMs offer quicker settlement times, which can improve cash flow for businesses.

- Adaptability to mobile commerce: With the rise of mobile shopping, having APMs like mobile payments is crucial for businesses to remain competitive.

- Valuable customer data: APMs can provide insights into customer behavior, which can be used for targeted marketing and business strategy.

- Environmentally friendly: Digital payment methods are often more sustainable than paper-based methods, aligning with the eco-friendly goals of many businesses.

- Flexibility in payments: Methods like BNPL offer customers flexible payment options, potentially leading to increased sales.

What is the alternative to payment?

The alternative to traditional payment methods like cash and credit cards are the APMs. These methods, ranging from digital wallets to cryptocurrencies, represent the evolution of payment systems in the digital era. They offer versatility and cater to the modern consumer’s need for convenience and security.

What is an alternative method that can be used to make payments?

An alternative method to make payments encompasses a range of options like digital wallets, bank transfers, cryptocurrencies, and BNPL services. These methods provide flexibility and ease, catering to different consumer preferences and transaction types.

Why is payment method important in business?

The choice of payment method is vital in business as it directly affects customer experience, transaction security, and operational efficiency. Offering a variety of payment options is crucial in today’s market to ensure customer satisfaction and loyalty, ultimately impacting the business’s bottom line.

Which payment method is best and why?

The “best” payment method depends on the business’s specific needs and customer base. However, digital wallets and mobile payments are gaining popularity due to their convenience and speed, making them a preferred choice for many businesses.

What does payment method mean in business?

In business, the payment method signifies not just the way transactions are processed but also a tool for customer engagement and market expansion. It involves understanding and catering to customer preferences, ensuring secure and efficient transactions, and leveraging these methods for business growth.

Incorporating APMs into a business strategy can provide significant advantages, including reaching a broader audience, improving customer satisfaction, and enhancing operational efficiency. As the world moves further into the digital age, staying updated with these payment methods is crucial for the growth and success of any business.

Take Control of Your Payment Strategy with Gr4vy

In the world of business, having the right payment strategy is key. That’s where we at Gr4vy come in. We get how important it is to offer a variety of payment methods, work with different payment providers, and create payment workflows that make sense for your business. Our goal? To help you make the most of every transaction.

If you’re ready to step up your payment game, we’re here to help. Let’s talk about how we can work together to streamline your payment systems, keep your customers happy, and drive your business forward.

Reach out to us at Gr4vy. We’re excited to work with you and tailor a payment plan that fits just right with your business needs. Contact us now, and let’s get started on transforming your transaction experience.