February 25, 2025

Payment orchestration platform: What it is and why your business needs one

- What is a payment orchestration platform?

- Payment orchestration meaning: A simple definition

- Do I need a payment orchestration platform? Key indicators for businesses

- Key features of a payment orchestration platform

- Why your business needs a payment orchestration platform

- How payment orchestration improves business operations

- Payment orchestration vs. payment gateways vs. middleware: which one does your business need?

- Comparison table: payment gateways vs. middleware vs. payment orchestration

- Which one does your business need?

- Challenges in adopting a payment orchestration platform

- How businesses can successfully adopt payment orchestration

- Frequently asked questions (FAQs) about payment orchestration platforms

- Why businesses should adopt payment orchestration now

The global digital payments market is projected to reach $14.78 trillion by 2027, with businesses processing millions of transactions across multiple payment providers, currencies, and channels. Yet, 15% of online transactions fail due to payment processing inefficiencies, leading to lost revenue and frustrated customers.

For businesses operating at scale—e-commerce, subscription-based services, marketplaces, and global enterprises—managing payments has never been more complex. They must deal with multiple payment service providers (PSPs), acquirers, fraud prevention tools, regulatory compliance, and transaction routing, all while trying to minimize costs and maximize approval rates.

This is where a payment orchestration platform (POP) comes in. Acting as a centralized payment layer, it connects, optimizes, and automates payment processes across multiple providers, ensuring businesses:

- Reduce failed transactions by routing payments dynamically.

- Lower transaction costs by selecting the most cost-effective payment processor.

- Improve fraud detection and compliance with built-in security features.

- Expand globally by integrating local payment methods and multi-currency support.

In this guide, we’ll break down what a payment orchestration platform is, how it works, and why businesses of all sizes should adopt one to stay competitive in the evolving payment landscape.

What is a payment orchestration platform?

Payment orchestration meaning: A simple definition

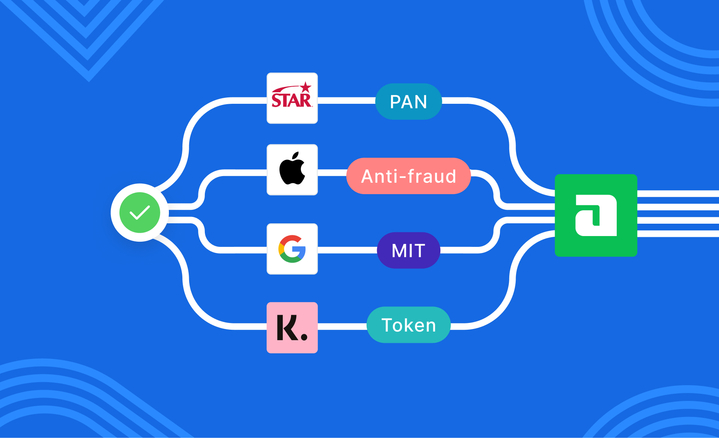

A payment orchestration platform (POP) is a centralized payment management system that connects businesses to multiple payment service providers (PSPs), acquirers, and fraud prevention tools through a single integration. It enables businesses to automate payment routing, optimize transaction success rates, reduce costs, and enhance security without relying on a single provider.

Unlike a traditional payment gateway, which only facilitates transactions between merchants and a single PSP, a payment orchestration platform dynamically selects the best payment route based on success rates, processing fees, geographic location, and fraud risk.

How a payment orchestration platform functions behind the scenes

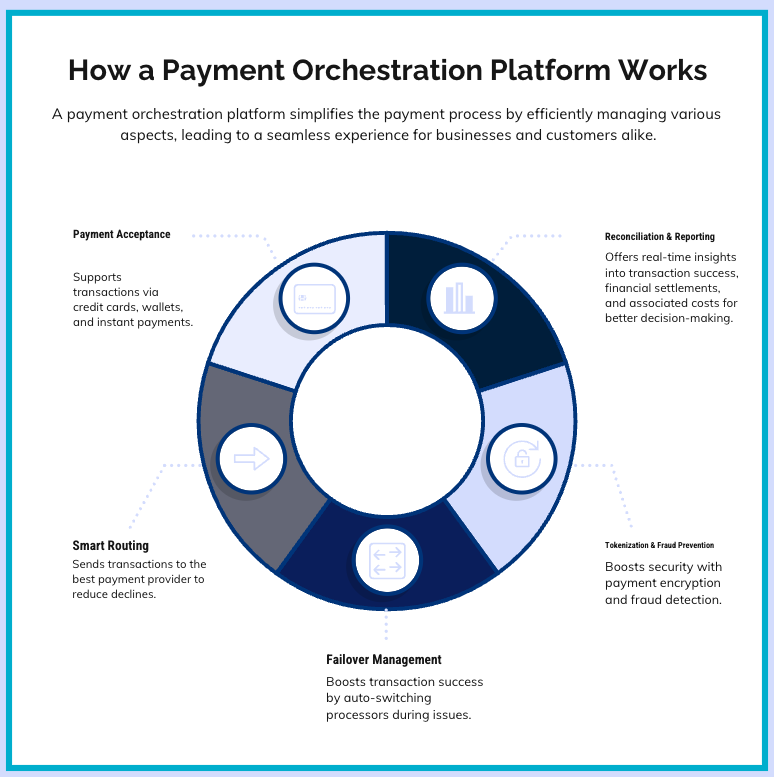

At its core, a payment orchestration platform streamlines payment processing by handling:

- Payment acceptance – Supports multiple payment methods, including credit cards, digital wallets, BNPL (buy now, pay later), and real-time payments.

- Smart routing – Directs transactions to the PSP or acquirer most likely to approve the payment, reducing declines.

- Failover management – Automatically retries failed payments with an alternative processor to increase conversion rates.

- Tokenization and fraud prevention – Secures transactions by encrypting payment data and integrating fraud detection tools.

- Reconciliation and reporting – Provides real-time analytics on transaction performance, settlement status, and costs.

By automating these processes, a payment orchestration platform removes the complexity of managing multiple payment providers, ensuring businesses operate with maximum efficiency and security.

The role of a payment orchestrator in multi-gateway payment management

A payment orchestrator acts as an intelligent payment control center, sitting between the merchant and multiple PSPs, ensuring:

- Higher payment success rates by optimizing transaction routing.

- Seamless global expansion by offering local payment methods and multi-currency support.

- Reduced costs by dynamically selecting the most cost-effective payment processor.

- Faster time to market by eliminating the need for multiple individual integrations.

Unlike middleware, which primarily facilitates communication between systems, and payment gateways, which only process transactions for a single provider, a payment orchestration platform provides complete control over the entire payment ecosystem.

Do I need a payment orchestration platform? Key indicators for businesses

If your business:

✔ Operates in multiple markets and uses different PSPs

✔ Deals with high transaction failure rates

✔ Wants to optimize payment processing fees

✔ Needs to comply with international payment regulations

✔ Requires fraud prevention and chargeback management tools

Then a payment orchestration platform is essential to streamline your payment operations and increase revenue.

Key features of a payment orchestration platform

A payment orchestration platform (POP) is more than just a payment processor—it is an advanced system that helps businesses manage and optimize transactions across multiple payment providers. Below are the essential features that set a payment orchestration platform apart.

Multi-payment service provider (PSP) integration

One of the core advantages of a payment orchestration platform is its ability to integrate with multiple PSPs, acquirers, and alternative payment methods through a single connection. This enables businesses to:

- Reduce dependency on a single payment provider

- Increase approval rates by dynamically selecting the best-performing PSP

- Expand globally by offering local payment options and multi-currency support

Instead of relying on a traditional gateway that processes payments through one provider, payment orchestration platforms ensure businesses have access to multiple options, reducing failed transactions and enhancing flexibility.

For more on how businesses can expand their payment options, read how to accept alternative payment methods.

Smart transaction routing for higher approval rates

One of the key challenges in payments is transaction declines, which can occur due to provider downtime, geographic restrictions, or security concerns. A payment orchestration platform increases approval rates by:

- Routing transactions to the PSP with the highest likelihood of approval

- Avoiding high-risk or high-fee processors that may reject transactions

- Automatically retrying failed transactions with an alternative provider

This intelligent routing system ensures that businesses maximize revenue by reducing unnecessary payment failures.

Automated failover mechanisms

Payment failures can result in lost revenue and a poor customer experience. A payment orchestration platform includes automatic failover mechanisms that prevent transaction failures by instantly rerouting payments when a provider declines them.

For example, if a customer’s payment fails due to a technical issue with the selected processor, the orchestration platform can automatically send the transaction to another PSP without requiring customer intervention. This improves the checkout experience while minimizing abandoned transactions.

Tokenization and fraud prevention tools

Security is a critical concern in payments, and payment orchestration platforms come with built-in fraud prevention measures, including:

- Tokenization, which replaces sensitive payment data with encrypted tokens, reducing security risks

- AI-powered fraud detection that analyzes transactions in real time to identify suspicious activity

- Multi-factor authentication and risk-based decisioning to prevent unauthorized transactions

For businesses concerned with PCI compliance and security best practices, understanding how to store card data safely is essential.

Cross-border payment orchestration

Businesses expanding internationally face challenges with local payment methods, multi-currency transactions, and regional compliance. A payment orchestration platform simplifies this by:

- Supporting multi-currency transactions, allowing customers to pay in their preferred currency

- Integrating with local payment methods such as Pix in Brazil, iDEAL in the Netherlands, and UPI in India

- Ensuring compliance with international regulations like PCI DSS, GDPR, and SCA

For businesses operating globally, payment orchestration provides the infrastructure needed to streamline international payments. To learn more, check out card acquiring for international markets.

Real-time analytics and reporting

A payment orchestration platform provides businesses with detailed insights into payment performance, allowing them to:

- Monitor transaction approval rates, failures, and refund trends

- Optimize payment routing based on real-time performance data

- Identify and mitigate fraud risks before they impact revenue

By leveraging data-driven insights, businesses can refine their payment strategies and make informed decisions on provider selection, fee management, and risk assessment.

Why your business needs a payment orchestration platform

Businesses that operate in multiple regions, rely on multiple PSPs, or face high transaction decline rates can benefit from a payment orchestration platform. By optimizing payment routing, enhancing security, and simplifying global transactions, payment orchestration platforms provide a scalable and efficient solution for modern payment processing.

For businesses looking to improve their payment strategy, contact Gr4vy to explore how payment orchestration can streamline transactions and improve success rates.

How payment orchestration improves business operations

A payment orchestration platform (POP) is not just a payment processing tool—it is a strategic asset that enhances business efficiency, reduces costs, and increases transaction success rates. By centralizing and automating payment management, businesses can improve their operational workflows and provide a better payment experience for customers.

Reducing transaction costs by leveraging multiple PSPs

One of the key benefits of a payment orchestration platform is its ability to optimize processing costs by dynamically selecting the most cost-effective payment provider. Instead of relying on a single acquirer or PSP, businesses can:

- Compare processing fees across multiple PSPs and automatically route transactions to the lowest-cost provider

- Reduce currency conversion fees by processing payments through local providers in each market

- Avoid unnecessary cross-border fees by routing payments through the appropriate regional payment network

By optimizing transaction routing, businesses can cut payment processing costs while maintaining high approval rates.

Improving success rates with intelligent routing and failover mechanisms

Payment declines are a major challenge for businesses, especially those operating at scale. A payment orchestration platform significantly improves success rates by:

- Dynamically selecting the best-performing payment provider based on real-time approval rates

- Automatically retrying failed transactions with an alternative PSP to prevent revenue loss

- Using AI-driven decisioning to optimize payment routing based on transaction history and fraud risk

For businesses looking to enhance approval rates and minimize failed payments, leveraging payment orchestration can have a direct impact on revenue. Learn more in this guide on approval rates in payments.

Enhancing fraud detection and security

Security risks and fraud remain significant concerns in digital payments. A payment orchestration platform integrates multiple fraud prevention tools, ensuring businesses can:

- Use tokenization to protect cardholder data and comply with PCI DSS

- Leverage AI-based fraud detection to identify and block suspicious transactions in real time

- Implement multi-factor authentication for high-risk transactions to reduce unauthorized activity

With fraud prevention integrated directly into the payment orchestration layer, businesses reduce chargebacks and financial losses while maintaining compliance with global regulations.

Ensuring compliance with payment regulations

As businesses expand into new markets, they must comply with region-specific payment regulations such as PCI DSS, GDPR, SCA, and PSD2. A payment orchestration platform simplifies compliance management by:

- Automatically enforcing regulatory requirements for each transaction

- Providing real-time audit logs and reporting tools for compliance tracking

- Ensuring customer data protection through encryption and tokenization

Businesses operating internationally must navigate complex payment regulations, making compliance automation a crucial feature. For a deeper look at compliance best practices, check out how to store card data safely.

Enhancing the customer experience with seamless payments

A frictionless payment experience is critical to customer satisfaction. Payment orchestration enhances the checkout process by:

- Reducing payment failures, ensuring a smoother purchasing journey

- Enabling local and alternative payment methods, improving conversion rates in different markets

- Providing real-time payment confirmation, increasing customer trust

By optimizing payment processing, businesses eliminate unnecessary friction, leading to higher customer retention and repeat purchases.

Why businesses should adopt payment orchestration

Businesses seeking to reduce costs, improve success rates, enhance security, and streamline compliance can benefit from implementing a payment orchestration platform. Instead of managing multiple payment providers manually, businesses can centralize all payment operations through a single, intelligent system.

Payment orchestration vs. payment gateways vs. middleware: which one does your business need?

As businesses scale, they face the challenge of selecting the right payment infrastructure. While payment gateways, middleware, and payment orchestration platforms (POPs) all facilitate transactions, they serve different purposes. Choosing the right solution depends on business size, transaction volume, and global expansion needs.

What is a payment gateway?

A payment gateway is a service that processes transactions between merchants and acquirers. It authorizes payments, encrypts sensitive cardholder data, and ensures funds are transferred securely.

Best for: Small-to-medium businesses that process payments through a single provider.

Key features:

- Direct connection to one or two PSPs

- Basic fraud protection and security encryption

- Works well for businesses with simple payment processing needs

Limitations:

- Limited to one or two PSPs, restricting flexibility

- Higher risk of failed transactions if the gateway is down

- No advanced routing or failover support

What is payment middleware?

Payment middleware is a software layer that helps businesses connect their payment gateway to multiple PSPs. It adds flexibility but does not provide full transaction orchestration.

Best for: Businesses that use multiple PSPs but do not need dynamic routing.

Key features:

- Integrates multiple PSPs without a full orchestration engine

- Reduces integration complexity

- Supports limited customization options

Limitations:

- No smart routing or failover capabilities

- Requires manual adjustments for optimization

- Does not provide built-in fraud prevention tools

What is payment orchestration?

A payment orchestration platform (POP) is a comprehensive payment management solution that connects multiple PSPs, acquirers, and fraud prevention tools while offering intelligent transaction routing, automated failover, and compliance support.

Best for: Businesses processing payments at scale, across multiple regions, and through various payment methods.

Key features:

- Multi-PSP support with dynamic routing for higher success rates

- Automated failover to reduce failed transactions

- Smart transaction routing to minimize fees and optimize approvals

- Compliance management for PCI DSS, SCA, and regional regulations

- Fraud prevention tools including tokenization and AI-driven risk detection

Limitations:

- Requires integration and setup for businesses transitioning from a traditional gateway

- Best suited for businesses handling high transaction volumes

Comparison table: payment gateways vs. middleware vs. payment orchestration

| Feature | Payment orchestration platform | Payment gateway | Middleware |

| Multi-PSP support | ✅ Yes | ❌ No | ✅ Limited |

| Smart transaction routing | ✅ Yes | ❌ No | ❌ No |

| Automatic failover | ✅ Yes | ❌ No | ❌ No |

| Fraud prevention | ✅ Advanced (AI-driven) | ✅ Basic | ✅ Basic |

| Compliance management | ✅ Yes | ✅ Yes | ✅ Yes |

| Best for | Global businesses, enterprises, marketplaces | SMBs, single-region businesses | Businesses needing limited automation |

Which one does your business need?

The right choice depends on your business model, growth plans, and transaction volume.

- If you only process payments through a single provider, a payment gateway is enough.

- If you need to connect multiple PSPs but don’t need dynamic routing, middleware is a basic solution.

- If you want to reduce costs, increase approval rates, and scale globally, a payment orchestration platform is essential.

Learn more about how payment orchestration platforms optimize global transactions in this guide on card acquiring for international markets.

Challenges in adopting a payment orchestration platform

While a payment orchestration platform (POP) offers numerous benefits, businesses often encounter challenges during implementation and scaling. Understanding these obstacles helps companies develop a strategic adoption plan to maximize the impact of payment orchestration while minimizing disruptions.

Infrastructure complexity and integration challenges

Adopting a payment orchestration platform requires businesses to integrate it into their existing payment stack, which may involve multiple PSPs, acquirers, and internal financial systems. Common challenges include:

- Technical integration with legacy systems – Businesses that rely on outdated payment gateways or middleware may face compatibility issues when migrating to modern orchestration solutions.

- Data synchronization across multiple providers – Ensuring consistent transaction data between the orchestration platform, PSPs, and internal finance tools requires robust APIs and real-time reporting.

- Customization needs – Some businesses may require tailored payment flows, which could involve additional development time for custom integrations.

To simplify the transition, businesses should partner with a payment orchestration provider that offers seamless API integrations, developer-friendly tools, and dedicated implementation support.

Regulatory compliance hurdles for global transactions

For businesses operating across multiple regions, compliance with payment regulations is a critical concern. A payment orchestration platform must adhere to various compliance requirements, including:

- PCI DSS (Payment Card Industry Data Security Standard) – Ensures secure storage, processing, and transmission of cardholder data.

- GDPR (General Data Protection Regulation) – Regulates the handling of customer payment data in the European Union.

- SCA (Strong Customer Authentication) and PSD2 – Requires additional verification steps for online payments in Europe.

- Local compliance requirements – Countries like India (RBI regulations), Brazil (Pix framework), and China (UnionPay rules) have region-specific payment regulations that businesses must comply with.

🔗 Learn more about secure payment processing and compliance in this guide on how to store card data safely.

Balancing cost savings vs. initial investment in payment orchestration solutions

Although payment orchestration reduces costs in the long run, businesses may hesitate due to initial setup costs, integration fees, and operational adjustments. Key cost considerations include:

- Subscription fees for orchestration platforms – Some providers charge a flat monthly fee, while others have transaction-based pricing models.

- Development and integration costs – Businesses may need technical expertise to integrate payment orchestration with existing systems.

- Training and operational adjustments – Employees may require training to fully leverage the platform’s features.

However, the cost savings over time outweigh the initial investment. A payment orchestration platform helps businesses:

- Reduce transaction fees by routing payments through the most cost-effective PSPs.

- Improve approval rates, leading to higher revenue retention.

- Streamline operational workflows, reducing manual intervention in payment processing.

For businesses looking to optimize payment expenses, understanding processing fees is essential. Read more in this guide on credit card processing fees.

Overcoming issues with legacy systems and outdated payment technology

Many businesses still operate with outdated payment gateways, manual reconciliation processes, and inflexible payment infrastructures. Challenges include:

- Slow transaction processing times – Legacy systems may struggle to keep up with real-time payment orchestration.

- Limited payment options – Older systems may not support alternative payment methods, BNPL solutions, or cryptocurrency transactions.

- Security vulnerabilities – Outdated payment technology lacks AI-driven fraud detection and tokenization features.

A modern payment orchestration platform helps businesses overcome these barriers by enabling real-time, scalable, and secure payment solutions.

How businesses can successfully adopt payment orchestration

To minimize disruption and maximize benefits, businesses should:

- Assess current payment infrastructure – Identify pain points in transaction approval rates, fraud prevention, and cost efficiency.

- Choose a payment orchestration provider with flexible integrations – Ensure compatibility with existing PSPs, e-commerce platforms, and financial tools.

- Plan for compliance and security requirements – Implement tokenization, AI fraud detection, and regulatory reporting.

- Monitor transaction performance – Use real-time analytics to track payment success rates and optimize routing strategies.

For businesses looking to enhance their payment ecosystem, a well-implemented payment orchestration strategy can drive revenue growth, reduce costs, and improve customer satisfaction.

Frequently asked questions (FAQs) about payment orchestration platforms

What is payment orchestration, and why is it important?

Payment orchestration is a technology layer that connects multiple payment service providers (PSPs), acquirers, and fraud prevention tools into a single, centralized system. It optimizes payment routing, reduces failures, and enhances security, ensuring businesses increase revenue while lowering transaction costs.

How does a payment orchestration platform differ from a payment gateway?

A payment gateway simply processes payments through one provider, whereas a payment orchestration platform manages multiple PSPs, dynamically routes transactions for the best success rate, and automates failover to reduce declines.

Which businesses benefit the most from payment orchestration?

Businesses that handle high transaction volumes, operate in multiple regions, or use several PSPs gain the most value. This includes:

- E-commerce companies that sell internationally

- Marketplaces managing multi-party payments

- Subscription-based businesses with recurring billing needs

- Enterprises looking to optimize payment costs and approval rates

Does payment orchestration improve security and compliance?

Yes. A payment orchestration platform integrates tokenization, AI-powered fraud prevention, and compliance automation, ensuring businesses meet PCI DSS, GDPR, and SCA requirements while reducing fraud risks.

How do I know if my business needs a payment orchestration platform?

If your business:

✔ Faces frequent payment failures or high decline rates

✔ Processes transactions across multiple regions or payment methods

✔ Wants to reduce payment processing costs

✔ Needs better fraud prevention and security features

✔ Finds managing multiple PSPs complex and time-consuming

Then, a payment orchestration platform is the best solution to streamline your operations.

Why businesses should adopt payment orchestration now

Payment orchestration is the key to optimizing global transactions, reducing failed payments, and improving the customer experience.

The long-term benefits of payment orchestration

By implementing a payment orchestration platform, businesses can:

- Improve approval rates by routing payments intelligently

- Lower costs by selecting the most cost-effective PSP

- Scale globally with seamless multi-currency and local payment support

- Strengthen security with AI-driven fraud prevention and compliance automation

Take control of your payments today

Managing payments doesn’t have to be complicated. With payment orchestration, businesses can unlock higher revenue, lower costs, and greater control over their payment operations.

Talk to a payment orchestration expert at Gr4vy to optimize your payments today.