November 12, 2024

Payment orchestration meaning: benefits and how it works

- What is payment orchestration?

- Understanding payment orchestration meaning

- Why payment orchestration is essential for modern businesses

- How does payment orchestration work?

- Key components of a payment orchestration layer

- Multi-provider routing and real-time transaction management

- Meaning of payment orchestration for businesses

- Cost reduction and efficiency

- Simplifying global payment operations

- Enhanced customer experience and conversion rates

- Infrastructure redundancy and failover routing

- Payment orchestration meaning: Real-world applications

- Ecommerce: simplified global payments

- SaaS platforms: improving subscription success rates

- Digital marketplaces: supporting multiple payment methods

- Key trends in payment orchestration for 2025

- AI-enhanced payment routing and decision-making

- Regional compliance and security innovations

- Expanding alternative and local payment methods

- How to choose the right payment orchestration platform

- FAQs about payment orchestration meaning

The complexity of managing digital transactions has grown exponentially as businesses expand their reach globally. Payment orchestration offers an advanced solution for companies, acting as a centralized layer that simplifies the management of multiple payment providers, enhances security protocols, and optimizes payment routing. This article provides a comprehensive overview of payment orchestration, why it’s vital in the digital commerce landscape, and the benefits it brings to businesses looking to streamline their payment infrastructure and meet modern customer demands.

What is payment orchestration?

Payment orchestration meaning: refers to the process of managing diverse payment methods, providers, and processes through a single, integrated platform. It’s a solution that goes beyond the basic functionality of traditional payment gateways by offering businesses enhanced flexibility and control over their payment operations. A payment orchestration platform connects companies to multiple payment service providers (PSPs), gateways, fraud prevention systems, and financial services, allowing seamless payment management.

Understanding payment orchestration meaning

In today’s landscape, businesses are increasingly dealing with multiple payment methods, including cards, digital wallets, and buy now, pay later (BNPL) options. With 1,050+ payment methods available globally, it’s essential for companies to offer the flexibility to accommodate customer preferences across different regions. Payment orchestration enables this flexibility by integrating with numerous PSPs, allowing businesses to support various payment methods without needing separate integrations for each one. This orchestration layer ensures businesses can operate more efficiently, meet customer expectations, and adapt to changing payment trends.

Why payment orchestration is essential for modern businesses

For businesses operating internationally, a payment orchestration platform is invaluable. It helps manage and optimize payments across different currencies, regions, and regulatory environments, creating a seamless payment experience for customers and reducing operational burdens. Unlike traditional payment solutions, which often limit businesses to a few options, a payment orchestration platform gives companies the ability to adapt rapidly to shifting payment trends and regulatory requirements.

Payment orchestration is particularly beneficial in enhancing transaction success rates. For example, with multiple payment options integrated, businesses can avoid transaction failures by automatically redirecting transactions to an alternative provider if the primary one is down or overloaded. This infrastructure redundancy is essential in reducing payment failures and increasing customer satisfaction.

Learn more about how Gr4vy’s payment orchestration platform can streamline your payment processes.

How does payment orchestration work?

Payment orchestration operates as a centralized layer that connects businesses to various payment providers, routing transactions based on set criteria such as cost, success rate, and compliance. It also handles critical aspects like compliance, security, and real-time monitoring. Here’s a breakdown of the main components of payment orchestration.

Key components of a payment orchestration layer

- API and SDK integrations: Payment orchestration platforms provide comprehensive APIs and SDKs, allowing businesses to connect to multiple PSPs, alternative payment methods (APMs), and fraud tools through a single integration. This reduces the complexity and time needed for setup, enabling businesses to adapt quickly to market needs.

- Dynamic routing: Dynamic routing is a key feature that assesses each transaction in real-time and directs it to the provider with the highest approval rate or the lowest transaction fees. This routing process reduces transaction failures and optimizes costs, benefiting both the business and the end-user.

- Compliance management: Compliance is a significant concern for businesses operating internationally. Payment orchestration platforms are PCI DSS compliant, ensuring data security and simplifying the process of meeting global and regional regulatory standards, which is especially critical as data protection laws evolve.

- Centralized management dashboard: With a centralized dashboard, businesses gain visibility into all transaction data. This allows them to monitor trends, track performance metrics, and identify areas for improvement, making data-driven decisions that optimize payment flows and enhance efficiency.

Multi-provider routing and real-time transaction management

One of the main advantages of payment orchestration is its ability to support multiple providers and manage transactions in real-time. By connecting with multiple providers, orchestration platforms offer smart routing that chooses the best provider based on specific criteria. This capability ensures that payments are processed through the most efficient route, reducing downtime and failures.

For example, if a primary payment provider experiences an issue, payment orchestration platforms can reroute the transaction to an alternative provider. This failover routing helps maintain transaction success rates and provides customers with a reliable, seamless experience. Real-time management also allows businesses to monitor transactions and address issues as they arise, improving both operational efficiency and customer satisfaction.

Meaning of payment orchestration for businesses

Payment orchestration provides several advantages for businesses, particularly as the global ecommerce market grows—projected to reach $5.8 trillion in 2023. These benefits range from reduced costs to improved user experience, making payment orchestration a valuable tool in any digital business’s payment strategy.

Cost reduction and efficiency

Payment orchestration can significantly lower transaction fees by enabling businesses to route payments to providers with the lowest costs. High-volume merchants, in particular, can take advantage of this optimization to negotiate better rates based on volume and route transactions accordingly, reducing the cost per transaction.

Simplifying global payment operations

For businesses that operate across multiple countries, payment orchestration provides an efficient way to manage international transactions. The platform supports over 1,050 different payment methods, giving companies the flexibility to offer region-specific payment options and reduce the barriers to global market entry. By simplifying these operations, businesses can better serve international customers and navigate complex regulatory landscapes with ease.

Enhanced customer experience and conversion rates

Customer experience is a crucial factor in transaction success. Studies show that 44% of UK consumers will abandon a purchase if their preferred payment method isn’t available. By integrating various payment methods and reducing payment failures, payment orchestration platforms enhance the customer journey, resulting in higher conversion rates and lower cart abandonment rates. This flexibility not only improves customer satisfaction but also directly impacts revenue.

Explore how Gr4vy’s payment orchestration solutions can improve customer experience.

Infrastructure redundancy and failover routing

Payment orchestration platforms offer failover routing, which automatically redirects transactions to an alternate provider if the primary one is unavailable. This infrastructure redundancy helps reduce failed payments, ensuring customers can complete their purchases without interruption. By increasing the likelihood of successful transactions, businesses can build stronger customer loyalty and maintain consistent revenue streams.

Payment orchestration meaning: Real-world applications

Payment orchestration is highly beneficial across various industries, with specific use cases in ecommerce, SaaS, and digital marketplaces. Each of these sectors benefits from the flexibility and scalability that orchestration provides.

Ecommerce: simplified global payments

Ecommerce businesses often operate in multiple regions, dealing with different currencies, payment preferences, and compliance requirements. Payment orchestration supports local payment methods, dynamic currency conversion, and real-time routing, allowing ecommerce companies to meet regional demands efficiently. By offering a seamless payment experience, orchestration platforms help ecommerce companies reduce cart abandonment and improve conversion rates.

SaaS platforms: improving subscription success rates

For SaaS providers, reliable recurring billing is essential to revenue stability. Payment orchestration assists with consistent billing cycles by managing retries and offering failover routing. If a primary payment provider experiences an outage, the orchestration platform can automatically route the transaction to an alternative provider, reducing subscription cancellations due to payment failures.

Digital marketplaces: supporting multiple payment methods

Digital marketplaces that serve a diverse customer base benefit from the versatility of payment orchestration, which enables them to support a wide range of payment options like BNPL and cryptocurrencies. This inclusivity attracts a broader audience, improving customer acquisition and retention rates. Furthermore, payment orchestration streamlines the process of managing payouts to sellers, which is essential in multi-seller environments.

Key trends in payment orchestration for 2025

The landscape of payment orchestration continues to evolve, with several key trends shaping its future. These trends underscore the importance of adopting a platform that is adaptable and scalable.

AI-enhanced payment routing and decision-making

Artificial intelligence is transforming payment orchestration, enabling platforms to make more informed routing decisions by analyzing transaction data patterns. AI can optimize payment routing by predicting the likelihood of transaction success, adapting to changes in provider performance, and reducing failed transactions. This intelligent decision-making increases approval rates and minimizes the cost impact of failed payments.

Regional compliance and security innovations

As ecommerce becomes more global, compliance with regional data protection laws and anti-fraud regulations is increasingly critical. Payment orchestration platforms are adopting automated compliance checks and implementing enhanced security protocols. In 2022, global ecommerce fraud reached $41 billion, underscoring the importance of effective fraud prevention. By centralizing compliance and security measures, orchestration platforms help businesses protect customer data and avoid regulatory penalties.

Expanding alternative and local payment methods

The demand for alternative payment methods (APMs) like digital wallets, QR payments, and real-time payments, which grew by 42.2% YoY in 2023, continues to rise. Payment orchestration platforms are integrating more of these options, allowing businesses to cater to customer preferences and improve the payment experience. This trend is essential for companies looking to expand internationally and accommodate diverse payment habits.

Learn more about compliance and fraud prevention features with Gr4vy.

How to choose the right payment orchestration platform

Selecting a suitable payment orchestration platform is critical to improving payment operations, reducing costs, and aligning with customer preferences. Here are key factors to consider:

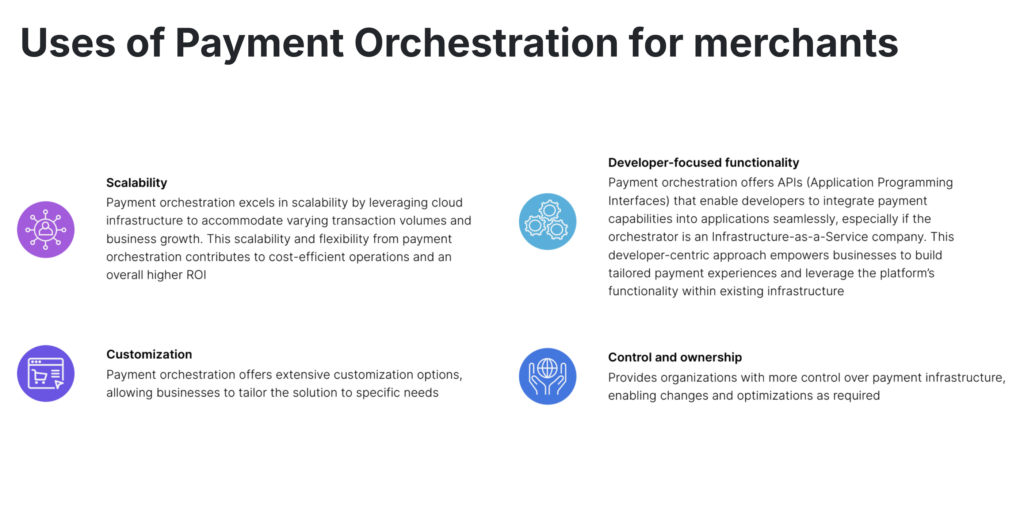

- Scalability: A scalable platform supports business growth, accommodating new payment methods and expanding to additional regions as needed.

- Flexibility: Choose a platform that allows customization of workflows, routing rules, and integrations to meet your unique business needs.

- Security: The platform should be PCI DSS compliant and offer robust fraud detection, safeguarding customer data and reducing the risk of breaches.

- Support for multiple payment methods: Look for a platform that supports a wide range of payment methods, including digital wallets and local payment solutions.

- Centralized dashboard and analytics: An ideal payment orchestration platform should offer comprehensive analytics to track transaction performance, enabling you to identify trends and optimize payment flows.

Explore Gr4vy’s platform and features to meet your payment orchestration needs.

FAQs about payment orchestration meaning

What is the meaning of payment orchestration?

Payment orchestration is a solution that consolidates multiple payment providers, fraud detection tools, and alternative payment methods into one streamlined platform, simplifying payment processes.

How does payment orchestration differ from a PSP?

Unlike PSPs that provide limited payment options, payment orchestration platforms integrate with multiple PSPs, gateways, and security tools, allowing for greater flexibility and control.

Can payment orchestration reduce transaction fees?

Yes, payment orchestration can help businesses route transactions based on fee optimization, reducing overall transaction costs and improving profitability.

What are the benefits of payment orchestration for ecommerce?

For ecommerce businesses, payment orchestration enhances global payment handling, supports local payment preferences, and reduces failed transactions, leading to better customer experiences and increased conversion rates.

Is payment orchestration secure?

Most payment orchestration platforms ensure PCI compliance and incorporate fraud prevention measures, securing customer data and preventing unauthorized transactions.

Payment orchestration is transforming the way businesses handle transactions, providing a centralized, optimized, and secure way to manage diverse payment methods and enhance customer experience. By adopting a payment orchestration platform, companies can simplify complex processes, reduce costs, and build a flexible payment infrastructure that supports growth in today’s digital-first economy.Ready to elevate your payment process? Contact Gr4vy today to learn how our payment orchestration platform can streamline your operations with efficient, secure payment solutions.