November 4, 2025

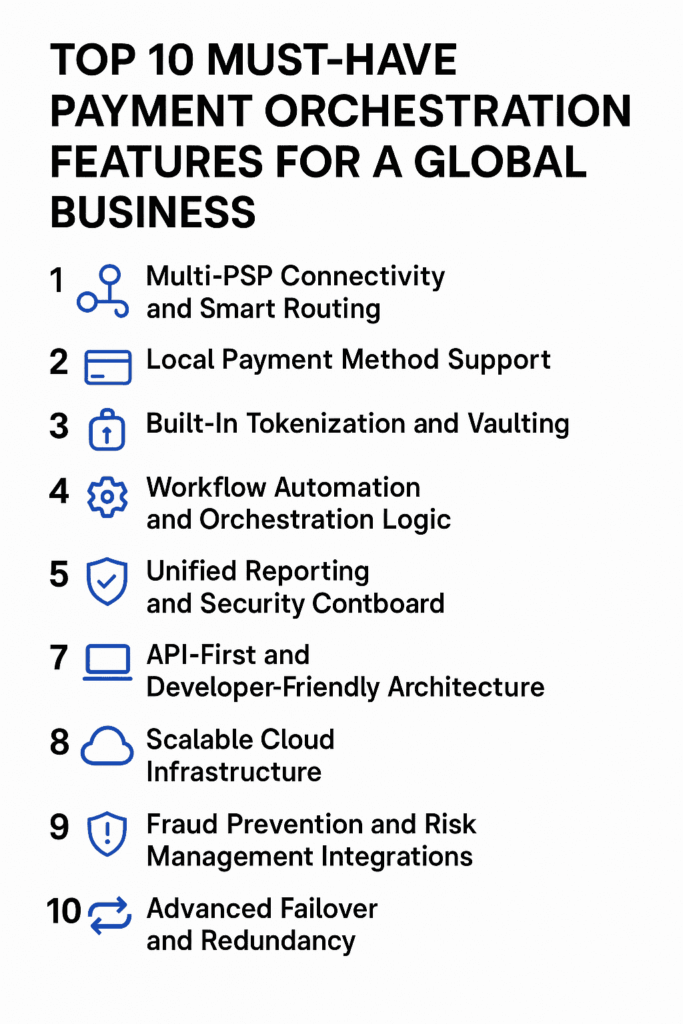

Payment orchestration in 2026: Top 10 must-have features for a global business

- 1. Multi-PSP connectivity and smart routing

- 2. Local payment method support

- 3. Built-in tokenization and vaulting

- 4. Workflow automation and orchestration logic

- 5. Unified reporting and insights dashboard

- 6. PCI DSS compliance and security controls

- 7. API-first and developer-friendly architecture

- 8. Scalable cloud infrastructure

- 9. Fraud prevention and risk management integrations

- 10. Advanced failover and redundancy

- Why these features matter for global growth

- FAQs

Going global used to mean opening new stores or building local teams. Today, it means being able to accept payments in many currencies, through different methods, and in compliance with each region’s rules. It is not just a technical task but a strategic one.

Every country has its own payment culture. Some rely on cards, others prefer instant bank transfers or mobile wallets. For a business trying to reach customers across continents, managing all these differences quickly becomes complicated. This is where payment orchestration changes the picture.

Instead of building and maintaining dozens of integrations, a payment orchestration platform brings everything together in one place. It connects providers, methods, and tools through a single layer that gives teams more control and visibility. The best platforms do much more than route payments. They help businesses scale faster, stay compliant, and adapt to local needs.

Here are ten essential features that every global business should look for when choosing a payment orchestration platform.

1. Multi-PSP connectivity and smart routing

The most important feature of any orchestration platform is the ability to connect to several payment service providers through a single integration. This gives businesses freedom to work with the providers that perform best in each market, without being tied to one.

Having multiple PSPs also means higher reliability. If one provider goes down, transactions can be automatically routed to another, keeping the checkout flow running. This redundancy prevents failed payments and protects revenue.

Smart routing makes the setup even more efficient. The platform analyses each transaction in real time and sends it to the provider with the highest chance of success. It can also take into account location, currency, cost, or card type.

This flexibility improves authorisation rates and helps merchants optimise their payment strategy without constant manual adjustments. It is the foundation of a truly global payment system. You can read more about how this works on Gr4vy’s payment orchestration page.

2. Local payment method support

Shoppers expect to see familiar payment options. When those options are missing, even loyal customers hesitate. Local payment support is therefore one of the strongest ways to increase conversion.

In the Netherlands, iDEAL is the go-to method for online purchases. In Brazil, Pix has changed the way people pay. In China, Alipay and WeChat Pay dominate. Each market has its own preferences, and supporting them can make the difference between a completed checkout and an abandoned cart.

A good orchestration platform gives businesses access to a wide range of local methods through one integration. Instead of building new connections each time you enter a country, you can activate local methods from a central dashboard.

This approach shortens time to market and reduces the cost of expansion. It also creates a better experience for customers who can pay in the way they trust most. For a deeper look into localisation, see Global revenue: how to localize payments without multiple integrations.

3. Built-in tokenization and vaulting

Security and compliance become more complex as a business grows internationally. Every country has its own data protection laws, and customers expect their payment details to stay safe. Tokenization and vaulting are what make this possible.

Tokenization replaces card numbers with unique tokens that have no value outside the payment system. Even if data is intercepted, it cannot be used elsewhere. Vaulting then stores these tokens securely for future transactions. Together they reduce PCI scope, improve compliance, and speed up repeat checkouts.

An advanced orchestration platform offers agnostic vaulting, meaning tokens can be used across multiple providers. This prevents vendor lock-in and makes it easier to switch PSPs or add new ones without losing saved data.

With tokenization and vaulting handled centrally, businesses can maintain both flexibility and security at scale. Learn more in Tokenization vs vaulting: what’s best for securing recurring payments?.

4. Workflow automation and orchestration logic

Payments involve more than taking money from one place and moving it to another. Behind every transaction there are retries, risk checks, notifications, refunds, and settlement tasks. Doing all this manually slows a business down and increases the chance of errors.

Workflow automation gives teams the power to define how payments should behave under different conditions. Instead of relying on developers to code complex rules, a visual or no-code interface lets teams set logic directly. For example, a failed transaction can automatically retry through a secondary PSP, or a high-value order can trigger an extra verification step.

This kind of automation saves time and keeps operations consistent across regions. It also helps businesses adapt quickly. When a market changes or a new regulation comes in, teams can update workflows immediately without waiting for new code releases.

Good orchestration logic combines flexibility with transparency. Every decision, from routing to retries, is logged and easy to review. That visibility builds confidence and simplifies auditing, especially for companies operating in several markets at once.

5. Unified reporting and insights dashboard

As a business grows, so does the number of payment providers, currencies, and reports to manage. Tracking performance across all of them can become a full-time job. A unified dashboard brings all that information into one clear view.

Through a single reporting layer, teams can monitor authorisation rates, decline reasons, fees, and chargeback trends. This data can be broken down by country, provider, or payment method, giving a full picture of how each market performs.

Beyond saving time, unified reporting helps businesses make better decisions. When you can see which PSP delivers the highest approval rate in a region, you can adjust routing rules to improve performance. When you spot recurring issues, you can act before they affect customers.

Finance and operations teams benefit too. Instead of exporting data from multiple dashboards, they can reconcile transactions and track settlement flows from one source of truth. Reliable insights reduce guesswork and create a stronger foundation for strategy and forecasting.

6. PCI DSS compliance and security controls

Compliance is one of the biggest challenges in payments. The Payment Card Industry Data Security Standard (PCI DSS) requires strict control over how card data is processed and stored. For global businesses, managing compliance independently for each integration is costly and time-consuming.

A payment orchestration platform simplifies this by taking on most of the compliance burden. Sensitive information is handled within the orchestration layer, keeping merchants out of PCI scope. This lowers audit complexity and reduces the resources needed to stay compliant.

Strong orchestration platforms also include advanced security features. Encryption, token lifecycle management, and detailed audit logs help protect data and maintain accountability. Combined with role-based access controls, these tools keep payment information secure from both external and internal risks.

Some providers also support regional frameworks such as GDPR or local data residency laws. That means global businesses can meet compliance requirements everywhere without rebuilding their systems for each country.

The result is smoother operations and stronger trust from customers who know their data is protected at every stage.

7. API-first and developer-friendly architecture

A flexible API is what allows payment orchestration to grow with a business. Instead of static systems that rely on manual configuration, an API-first design lets developers integrate new services quickly and customise how payments flow.

An API-first approach also keeps innovation fast. Developers can test new PSPs, add payment methods, or connect fraud tools without disturbing the live environment. A strong orchestration platform supports this through clear documentation, SDKs, and webhooks that keep teams informed of every event in real time.

When development teams have this kind of control, they can adapt faster to local requirements or launch experiments that improve conversion. It turns payments from a back-office function into a core part of business strategy.

8. Scalable cloud infrastructure

Global businesses process payments around the clock, and their systems need to perform just as reliably at peak traffic as during quiet hours. Cloud-native infrastructure makes that possible.

A cloud-based orchestration platform scales automatically to handle higher transaction volumes, no matter where customers are located. It also distributes workloads across data centres, reducing latency and improving response times. This keeps checkout experiences fast and consistent worldwide.

Scalability is not only about performance. It is also about continuity. If one data centre or provider goes offline, traffic is redirected automatically to healthy systems. This resilience prevents downtime and protects revenue during high-demand periods or unexpected disruptions.

By relying on cloud infrastructure, businesses gain the reliability and reach they need without having to manage hardware or worry about regional capacity limits.

9. Fraud prevention and risk management integrations

Fraud looks different in every market. What works in one region might not apply in another. Payment orchestration simplifies how businesses connect to fraud prevention tools and risk engines.

Through one integration, merchants can plug in third-party fraud solutions, identity checks, or behavioural analytics tools. Rules can then be applied globally or tailored per country, PSP, or payment type. For example, higher-value transactions can go through extra verification steps, while low-risk payments can be processed instantly.

This flexibility helps balance security and user experience. Instead of rigid rules that block legitimate customers, orchestration enables a more adaptive approach to risk. Businesses can update or test new fraud tools quickly, ensuring that protection evolves as threats change.

A well-integrated risk layer also supports regulatory requirements, such as strong customer authentication, helping merchants stay compliant while reducing chargebacks and losses.

10. Advanced failover and redundancy

No payment provider, gateway, or network is immune to technical issues. What matters is how quickly the system recovers. Advanced failover ensures transactions keep flowing even if one route fails.

An orchestration platform with built-in redundancy automatically detects issues and reroutes transactions through alternative paths. This prevents downtime and keeps the checkout process smooth for customers. Businesses stay operational even when one provider faces temporary disruptions.

Redundancy also supports planned maintenance and regional outages, allowing teams to maintain performance without manual intervention. The goal is continuity — a system that customers can rely on every time they pay.

Why these features matter for global growth

These ten features together form the backbone of a strong payment infrastructure. Multi-PSP routing improves reliability, local methods boost conversion, tokenization and vaulting secure customer data, and automation brings agility to global operations.

When combined, they turn payments into a competitive advantage. Businesses gain flexibility, transparency, and control while reducing complexity and cost. Instead of constantly reacting to new markets or regulations, they can move with confidence, knowing their payment stack can adapt to whatever comes next.

To explore how orchestration supports growth, visit Top 10 benefits of using payment orchestration in 2025.

FAQs

What is a payment orchestration platform?

A payment orchestration platform connects multiple PSPs, payment methods, and tools under one layer. It simplifies integrations, reduces maintenance, and gives businesses control over how transactions are processed.

How does payment orchestration support global expansion?

It lets businesses connect to local providers and methods in new markets without complex integrations. This reduces launch times, improves acceptance rates, and ensures compliance with local regulations.

What are the benefits of multi-PSP routing?

Multi-PSP routing improves approval rates and reduces downtime by sending each transaction through the best-performing provider at that moment.

Why is tokenization essential in payment orchestration?

Tokenization replaces card data with secure tokens. This protects customer information, supports compliance, and allows businesses to process recurring or cross-provider payments safely.

Contact Gr4vy to learn more about payment orchestration and how it can help your business grow globally.