October 28, 2021

How merchants can modernize payments infrastructure and go global

Worldwide growth in payment methods and processors has led merchants to build complex payment infrastructure that requires dedicated in-house payment teams. This approach, however, incurs technical debt, inflexibility and potential regulatory challenges.

Interestingly, payment orchestration is not a new idea, but what is different is the accelerated drive toward digital transformation and the advantages of cloud computing. Surprisingly, every company that sells online is building or has built the same piece of payment software. Software that’s nowhere near good enough for true digital transformation nor allows merchants to expand and control their payment stack from anywhere.

It’s time payment orchestration got an upgrade to serve customers’ needs. By combining the power of payment platforms with the cloud, merchants can gain a genuinely modern payment infrastructure to deliver multiple payment options consumers demand, regardless of location.

Understand the evolution of payments

Early in the days of internet payments, we used dial-up modems that dialed into banks to make payments and adapt the Point of Sale infrastructure that already existed to work online. Mainframe solutions, data centers and archaic network protocols necessitated payment companies to run data centers and payment gateways existing as literal gateways with physical addresses and plenty of hardware. Merchants who worked with this pre-cloud infrastructure had to make significant investments in hardware to accept money.

Following this came more internet-friendly API-type solutions using back-end languages, such as C and Java. These allowed a merchant’s internet-facing front end to route payments through a back-end server to internet-enabled gateways using IP and APIs or SDKs. However, when done poorly, many consumer payment details were held unencrypted in storage and databases, leading to enough breaches that the card associations stepped in and mandated PCI certification for companies holding this kind of data. This action increased the cost of maintaining a payment system, so much so that small merchants found it out of reach.

The industry reacted, and a hosted payment page became a common way to integrate along with solutions such as PayPal. This further evolved to frames, pop-ups and even hosted fields. As time has gone on, the complexity of these systems has required merchants to choose; invest in internal infrastructure to manage how different payment options interact with the rest of operations or don’t accept various payment methods and lose potential customers.

Take payments to the cloud

The boom in fintech has massively increased the variety of ways to pay, and not offering customers their preferred ways to pay has shown they are more likely to abandon a cart. Unsurprisingly, it’s a complex problem, but not one that merchants can’t overcome by eliminating the need for large payments teams and taking payments and payment orchestration to the cloud.

To build scalable cloud-native payment infrastructure, you need to add a layer that can orchestrate and standardize all the payment methods that consumers require in a way that utilizes the benefits of cloud computing without taking on the burden of PCI compliance. Your server-less functions should remain dormant until a consumer needs that payment method. Unified reporting should be replicable and available wherever your accounting team sits – home or otherwise – and Edge computing should push user experiences closer to customers and their specific needs.

The advantage of being able to scale your payment infrastructure up and down based on peaks and valleys in your annual sales cycles is a huge benefit of a cloud-native payment orchestration platform. Moreover, it offers significant savings that can increase your bottom line.

‘Go Data-Centric’ and ‘Get Regulatory Compliant Privacy’ concerns have increased around the world. Data breaches continue to rise, leaving customers skeptical of how their data is held, with governments reacting in turn to protect their citizens. Several countries have blocks and set rules on what and where data can be kept on their citizens.

We can already see examples. In India, the Reserve bank has set explicit rules around transactional data like card numbers and bank details and how they may not leave the country and must reside in local storage. European GDPR rules are another example, and the fallout from the collapse of the Privacy Shield regulation means that if a US Customer Service agent looks at customer data, then there is a breach of privacy even if that data is held locally. The problem is that most payment companies and solutions are not built to be distributed, and breaking a monolithic stack into parts is a challenging task for a payment processor and a merchant.

To become future-proof and ready to deal with the rapidly changing regulations, merchants need to start looking towards the benefits of Edge computing, which can keep data local while still allowing access to locally regulated payment companies and types.

Tokenize for the future

One way to keep yourself PCI compliant as a merchant is to tokenize your customers’ payments details at the payment service provider (PSP) level or to go deeper at the association level. Either way, there is a future where you, as a merchant, will need to store and interact with multiple tokens per customer.

For example, you could have a situation where for customer X, you need to use token Y on processor Z. However, if customer X is using another of your brands or is on mobile or in-store, then customer X will have to use token A on processor B.

Managing these tokens and keeping them up to date in a controllable fashion is soon to become a major headache for all merchants. It’s essential to develop a strategy for doing this now, particularly with network tokens, as it can create cost savings if done correctly. Of course, whatever you use to manage this needs to be cloud native and potentially Edge ready to keep you locally compliant.

As payments move to the cloud, don’t be afraid to modernize your payment infrastructure, take on digital transformation and go global. Look to build or buy cloud native payment orchestration that takes advantage of the benefits of cloud technology, such as auto-scaling, Edge computing for local compliance and cloud-based self-updating vaulting technology. With this foundation, you will be able to take on whatever the future holds.

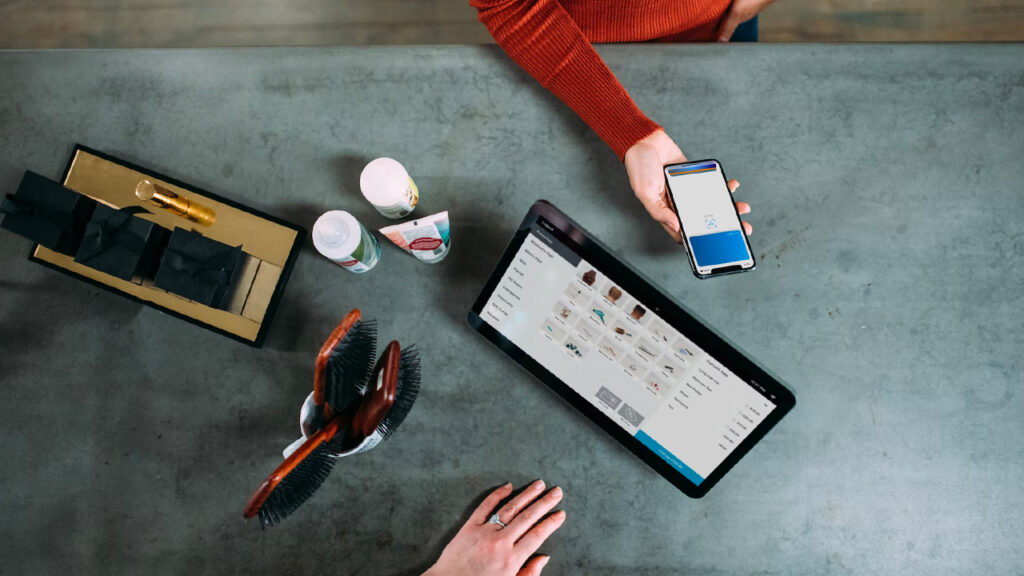

Gr4vy’s POP leverages the power of the cloud to give users the capability to streamline and manage payment methods, services, and transactions all in one place. Its orchestration layer upgrades a company’s payment stacks to make infrastructure nimbler. While its intuitive, no-code dashboard centralizes the integration and administration of payment methods, providers, conditions, and transactions. With Gr4vy, you never have to lose a transaction again. For more information, please visit gr4vy.com.

This article first appeared on PaymentsJournal