July 14, 2025

Payment orchestration vs in-house integration: build vs buy explained

Global ecommerce sales reached over 6 trillion dollars in 2023 and are expected to keep growing as businesses expand into new markets with diverse payment expectations. For merchants and platforms, supporting these local payment methods is essential for reducing cart abandonment, improving approval rates, and maintaining a seamless customer experience.

One of the most important choices teams face is whether to build their payment integrations in-house or adopt a payment orchestration platform. This decision affects how quickly they can enter new markets, how much they spend on development and maintenance, and how reliable their payment systems will be under heavy demand.

This guide breaks down the trade-offs between building and buying, helping merchants and developers choose the approach that best supports their long-term growth.

The challenges of integrating payments in-house

Building payment integrations in-house can seem like a smart choice at first. It offers complete control over the integration process, data flows, and provider relationships. Many engineering teams see it as a way to customize the payment experience exactly to their brand.

But as a business grows, this approach quickly reveals its limitations. Managing multiple payment service provider (PSP) integrations means supporting different API structures, authentication methods, data formats, and error codes. Each PSP might have unique quirks that require special logic, making the overall codebase harder to maintain.

When entering new markets, merchants often need to add local payment methods that customers expect, like regional wallets, QR-based systems, or real-time bank transfers. Building support for each of these methods is time-consuming and costly. Every new payment method introduces additional testing, compliance checks, and documentation updates.

Fraud prevention is another area that adds complexity. Integrating with fraud detection tools often means working with separate APIs, scoring models, and business rules. Orchestrating when and how to apply fraud checks across multiple payment providers becomes an ongoing operational challenge.

Compliance with regulations, such as PCI DSS, is also a critical responsibility. Storing, processing, and transmitting payment data securely requires maintaining rigorous security practices and undergoing regular audits. Managing these requirements internally can be demanding, especially for companies without dedicated security and compliance teams.

The cost of building these integrations is not limited to the initial development effort. Once live, each integration requires ongoing maintenance to handle API changes, security patches, version deprecations, and evolving fraud patterns. Teams must ensure that all integrations continue to meet performance expectations, even during traffic spikes or seasonal demand.

Operationally, handling retries, routing decisions, and provider failover adds further complexity. Without a structured approach, these elements can become hard-coded or spread across different services, making it difficult to maintain consistency and troubleshoot issues when things go wrong.

All these factors add up to significant technical debt. Over time, the initial flexibility of in-house integration can become a burden that slows development, increases costs, and reduces a company’s ability to respond to new market opportunities.

What is payment orchestration?

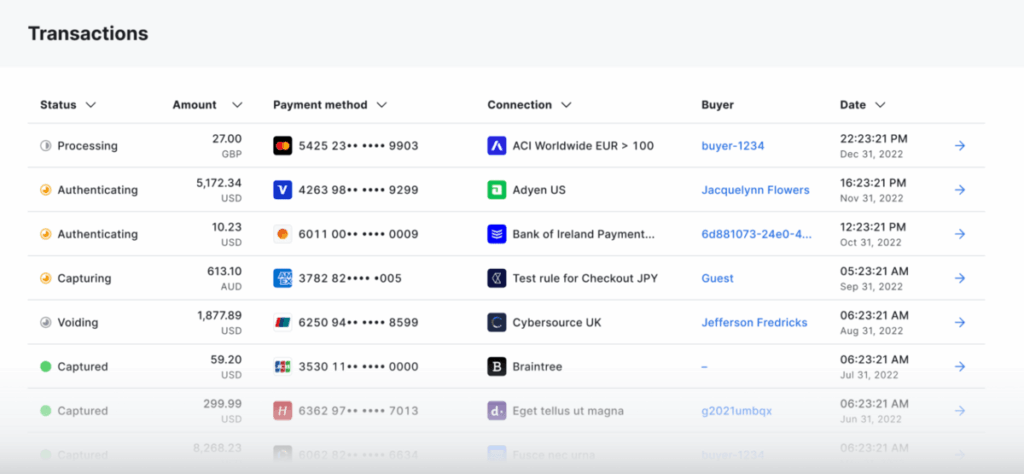

Payment orchestration is a technology approach designed to simplify how merchants manage multiple payment providers, methods, and fraud tools. Instead of building and maintaining separate integrations for each provider, businesses connect once to an orchestration platform that unifies everything behind a single interface.

At its core, payment orchestration acts as a control layer. It standardizes payment data, manages routing rules, and handles retries automatically. This means when a customer initiates a payment, the orchestration layer decides which provider to use based on rules like geography, cost, or success rates. If a provider is unavailable or declines a transaction, the system can retry with another provider seamlessly.

For developers, orchestration simplifies the integration process dramatically. Teams work with one consistent API instead of juggling many different provider formats. This reduces complexity, shortens development timelines, and minimizes errors.

Orchestration also supports adding new payment methods without reengineering the entire checkout experience. When a merchant wants to support a new digital wallet or local payment rail in a new market, it often only requires configuration changes rather than full-scale development.

Another critical benefit is the ability to integrate fraud detection tools, local acquiring partners, and payment analytics into the same platform. Orchestration layers can manage these connections centrally, ensuring that fraud checks, approvals, and reporting all stay consistent no matter which provider is used.

For merchants planning to expand globally or improve reliability, payment orchestration offers a strategic advantage. It provides the flexibility to adapt to local payment preferences, manage operational risks, and maintain high performance even during periods of heavy demand.

If you want to see how this approach can simplify your payment strategy, learn more about payment orchestration and its benefits for merchants of all sizes.

Build vs buy: Cost considerations

Deciding whether to build payment integrations in-house or use a payment orchestration platform often starts with evaluating costs. At first glance, building in-house seems cheaper. The company pays its own developers and owns the entire integration process. But a closer look reveals many hidden and ongoing costs that can add up quickly.

The first and most obvious cost is development time. Building robust payment integrations with multiple PSPs, local payment methods, fraud tools, and security requirements takes months. Engineering teams must design the integration, implement it, test every scenario, and handle compliance requirements like PCI DSS. This can delay product launches and limit the company’s ability to enter new markets quickly.

Maintenance is another major cost. PSP APIs change over time. New payment methods emerge. Fraud patterns evolve, requiring updated detection tools. Each change demands developer time for updates, testing, and deployment. This is not a one-time effort but an ongoing responsibility that requires constant attention.

Opportunity cost is just as important. Every hour developers spend maintaining payment infrastructure is time not spent on improving the core product or building features that drive competitive advantage. Teams focused on payments may be stretched thin, slowing down other critical projects.

There are also operational costs to consider. Engineering teams must monitor integrations, handle failed transactions, manage retries, and ensure uptime during peak demand. Supporting multiple providers increases the need for logging, monitoring, and alerting systems to detect and resolve issues quickly.

Payment orchestration platforms reduce these costs in several ways. They spread development and maintenance across many merchants, lowering the per-user cost. They handle updates to PSP integrations centrally, reducing the burden on in-house teams. They also provide built-in routing, retries, and failover logic, removing the need for custom solutions.

When comparing total cost of ownership over several years, orchestration often proves more economical. It frees engineering resources to focus on core business goals while ensuring payments remain reliable, up to date, and secure.

Flexibility and speed to market

Expanding into new markets or serving diverse customer bases requires flexibility in supporting local payment methods. Each market has its own preferred wallets, cards, and real-time bank transfer systems. Customers expect to see familiar options at checkout, and failing to support them can lead to abandoned carts and lost sales.

Building these integrations in-house often means long development timelines. Teams must research providers, negotiate access, implement custom code, and test thoroughly. Launching in a new country can take months, delaying revenue and giving competitors an advantage.

Payment orchestration platforms make this process faster. They maintain existing integrations with hundreds of PSPs and local payment methods. Adding support for a new provider usually requires only configuration changes, not new code. This reduces time to market dramatically, allowing merchants to move quickly when opportunities arise.

Local acquiring is another critical factor. Transactions processed through local acquirers often see higher approval rates and lower fees compared to cross-border attempts. Orchestration platforms simplify managing local acquiring relationships, enabling merchants to deliver a better customer experience while improving profitability.

Flexibility also matters when customer preferences evolve. As new payment methods gain popularity, merchants need the ability to add them quickly without reengineering checkout flows. Orchestration supports this adaptability, ensuring the business can meet customer expectations now and in the future.

Developer experience and integration debt

For engineering teams, building and maintaining multiple payment integrations can create a growing burden over time. Each PSP has its own API specifications, authentication methods, error codes, and data formats. Developers need to account for these differences in the codebase, which increases complexity and makes onboarding new team members more challenging.

Testing and maintaining these integrations also demands time and effort. Developers have to manage sandbox environments for each provider, keep up with API version changes, and ensure all integrations remain secure and reliable. Without careful planning, this work can accumulate as integration debt, slowing down future projects and increasing the risk of bugs.

Payment orchestration platforms reduce this complexity by providing a consistent, standardized API across all payment providers. Instead of learning and maintaining multiple systems, developers work with one interface, one set of error codes, and one documentation source. This improves developer experience, reduces errors, and allows teams to focus on building features that deliver value to customers.

Reliability and redundancy

Payment systems need to be reliable, especially during busy periods like sales events or holiday seasons. Relying on a single PSP introduces risk. If that provider has downtime, latency issues, or maintenance windows, transactions can fail, harming the customer experience and reducing revenue.

Building robust failover logic in-house is complex. It requires custom routing, monitoring, and retries to ensure transactions are completed even when providers face issues. This adds operational overhead and demands deep payment expertise.

Payment orchestration platforms address this by supporting multiple PSPs with built-in routing and automatic retries. If one provider fails, transactions can be rerouted to another seamlessly. Merchants benefit from higher uptime, fewer failed transactions, and improved customer trust.

Security and compliance

Handling payments securely is critical for protecting customer data and maintaining trust. Any merchant that processes card payments must comply with PCI DSS standards. This involves securing data in transit and at rest, implementing strict access controls, and undergoing regular audits.

Managing PCI compliance in-house adds significant responsibility to engineering and security teams. Beyond PCI, merchants must also account for local data storage requirements, privacy laws, and the need to integrate fraud detection tools.

Payment orchestration platforms simplify this by providing PCI-compliant storage and transmission out of the box. They often include built-in fraud prevention tools and enable merchants to integrate additional services as needed, all while maintaining consistent security practices. By centralizing these responsibilities, orchestration platforms reduce the burden on internal teams and lower the risk of non-compliance.

Action plan: Choosing the right strategy

Merchants deciding between building in-house or using an orchestration platform should start with a clear evaluation of their needs. Consider current payment volumes, geographic markets, and the diversity of payment methods required.

Assess internal development resources honestly. Building and maintaining multiple PSP integrations demands time, expertise, and a long-term commitment to updates and security. Weigh these costs against the opportunity cost of not developing other features or improvements for your customers.

Think about future plans. If entering new markets is a priority, supporting local payment methods quickly and reliably will be essential. Orchestration platforms enable faster launches and greater flexibility without extensive development cycles.

Finally, consider the operational risks of downtime, fraud, and compliance failures. An orchestration layer can improve redundancy, simplify fraud management, and maintain consistent security across providers.

Frequently asked questions

What is payment orchestration?

Payment orchestration is a technology layer that connects multiple payment service providers, fraud tools, and local payment methods through a single integration. It standardizes data and routing, making payments easier to manage.

Why is building payment integrations in-house challenging?

In-house builds require maintaining separate APIs, managing fraud detection, ensuring PCI compliance, and adapting to changing payment methods. This creates ongoing development and operational complexity.

How does orchestration reduce payment integration complexity?

It unifies multiple PSPs behind one API, standardizes error handling, and includes routing and retries. This simplifies development and reduces the burden on engineering teams.

Can orchestration improve approval rates?

Yes, by supporting local acquiring and smart routing, orchestration helps transactions succeed more often, especially in new markets.

Is orchestration secure and PCI compliant?

Most orchestration platforms offer PCI-compliant storage and built-in fraud prevention tools, helping merchants maintain security and compliance with less effort.

Payment orchestration platforms reduce complexity, improve reliability, and make it easier to support local payment methods as customer expectations evolve. For businesses planning to expand globally or strengthen their payments infrastructure, orchestration is a proven approach to simplify integration and deliver a better experience.

If you’re ready to explore how orchestration can help you build a more flexible and resilient payment strategy, contact Gr4vy to get started.