February 3, 2025

Test credit card numbers: what they are and how to use them

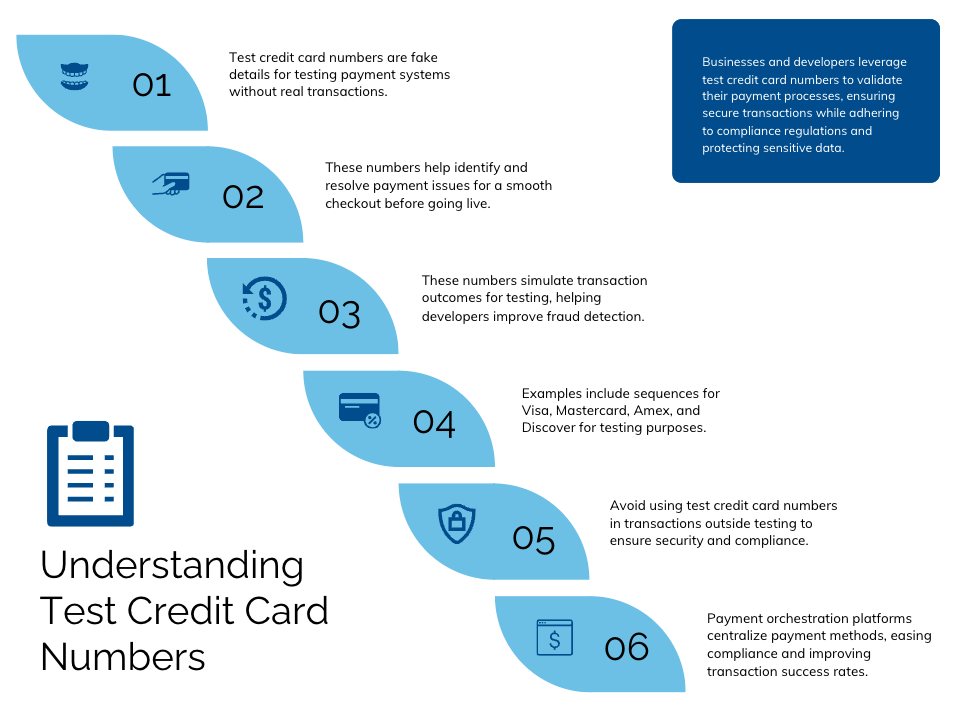

Businesses and developers often need to test payment systems before going live for online transactions. This is where test credit card numbers come into play. These are specially generated numbers that mimic real credit cards but do not hold any financial value. They allow businesses to simulate transactions, check for errors, and ensure their payment gateway works correctly.

For merchants, understanding credit card test card numbers is crucial to preventing fraud, optimizing checkout experiences, and complying with security regulations. Payment orchestration platforms make this process more efficient by streamlining the integration and testing of various payment methods.

This guide will cover everything you need to know about credit card test numbers, including how they work, how to generate them, and how scammers might misuse them.

What are test credit card numbers?

Test credit card numbers are dummy card numbers used for testing payment processing systems. They are provided by payment networks like Visa, Mastercard, and American Express to help businesses simulate real transactions without processing actual funds.

These numbers follow the Luhn algorithm, the same validation method used by real credit cards. However, they are restricted to sandbox environments, meaning they won’t work for real transactions. Developers and merchants use them to:

- Test payment gateway integrations

- Validate fraud detection mechanisms

- Check the handling of transaction errors and declines

- Ensure smooth user experience in credit card numbers for ecomm testing

If you are handling sensitive payment data, it’s essential to understand best practices for storing and securing cardholder information. Read more about how to store card data safely.

How to test credit card numbers

When testing a payment gateway or e-commerce checkout system, businesses need to simulate different types of transactions. This involves using testing credit card numbers to assess:

- Successful transactions – Ensuring payments go through when valid credit card numbers for testing are entered.

- Failed transactions – Testing scenarios where payments fail due to incorrect details or declined transactions.

- Refunds and chargebacks – Checking how the system processes refunds and disputes.

- 3D Secure authentication – Verifying if additional security layers, like OTP-based authentication, function correctly.

Each payment processor provides its own list of credit card testing numbers, which typically include different card networks, expiration dates, and CVV codes to test various transaction scenarios.

How scammers test credit card numbers

While random test credit card numbers are meant for legitimate testing, fraudsters use similar techniques for illicit purposes. This is known as card testing fraud, where cybercriminals attempt to validate stolen card details by making small transactions on different platforms.

Signs of credit card test numbers fraud include:

- Multiple small-value transactions from the same IP address

- Unusual spikes in declined transactions

- Different cards being tested in rapid succession

- Mismatched billing and shipping addresses

To combat fraudulent credit card testing numbers being used on your site, businesses can implement fraud prevention tools, enable velocity checks, and work with payment orchestration platforms to monitor suspicious activities. Learn more about credit card decline codes and how to fix them.

How to generate test credit card numbers

Businesses and developers can generate test credit card numbers using tools provided by payment networks and processors. These generators follow the Luhn algorithm and typically include:

- Card number – A 16-digit number that passes validation checks.

- Expiration date – A future date that mimics a real credit card.

- CVV – A three-digit security code for authentication testing.

- Card brand – Visa, Mastercard, American Express, or Discover.

Some payment orchestration platforms offer built-in tools for testing credit card numbers for e-commerce transactions, streamlining the development and compliance process.

How to test CVV credit card numbers

The Card Verification Value (CVV) is a critical security feature for online transactions. When testing payment systems, businesses must check how credit card test card numbers validate CVVs. This involves:

- Entering valid CVVs – Ensuring transactions succeed when the correct test credit card numbers are provided.

- Using incorrect CVVs – Confirming that the system rejects payments with mismatched CVVs.

- Testing stored card transactions – Checking whether CVVs are required for recurring billing setups.

Testing credit card numbers for CVV authentication helps businesses prevent fraud and comply with PCI DSS standards. Learn more about how credit card schemes work.

Why businesses should use payment orchestration for testing

Manually testing credit card numbers across multiple payment gateways can be time-consuming and complex. A payment orchestration platform simplifies the process by:

- Centralizing the testing of multiple payment methods

- Reducing failed transactions by routing payments intelligently

- Automating compliance with security standards

- Providing built-in fraud detection and decline management tools

For businesses handling high transaction volumes, leveraging payment orchestration can improve success rates and streamline operations. If you want to understand the costs associated with processing transactions, check out credit card processing fees.

Frequently asked questions about test credit card numbers

How to test real credit card numbers?

Testing real credit card numbers is not recommended due to security and compliance risks. Instead, businesses and developers should use test credit card numbers, which are provided by payment networks for testing purposes. These numbers work in sandbox environments to simulate real transactions without processing actual payments. Using live credit card data for testing could lead to accidental charges, security breaches, or non-compliance with PCI DSS regulations.

Is it illegal to use test credit card numbers?

No, it is not illegal to use test credit card numbers as long as they are used in designated testing environments, such as payment gateways’ sandbox modes. However, using them for real transactions, fraudulent purposes, or unauthorized testing can lead to legal consequences. Always ensure you are testing within compliant frameworks provided by legitimate payment service providers.

What are some credit card numbers for test accounts?

Many payment providers offer specific credit card test card numbers for sandbox testing. Examples include:

- Visa: 4111 1111 1111 1111

- Mastercard: 5555 5555 5555 4444

- American Express: 3782 822463 10005

- Discover: 6011 0009 9013 9424

These numbers allow merchants to validate payment processing workflows without using real financial data. Each provider may have additional test cases to simulate declined transactions, expired cards, or CVV mismatches.

What are test credit card numbers for?

Test credit card numbers are used by businesses, developers, and payment processors to simulate online transactions. They help ensure that payment gateways, fraud detection tools, and checkout processes function correctly before going live. These numbers prevent errors, reduce fraud risks, and improve transaction security without exposing actual cardholder data.

What are test credit card numbers used for?

- Simulating successful and failed transactions

- Verifying fraud prevention mechanisms

- Testing e-commerce checkout flows

- Ensuring compliance with payment regulations

- Debugging payment processing issues

By using credit card numbers for testing, businesses can optimize their payment systems while safeguarding customer data.

What does it mean by test credit card numbers?

A test credit card number is a non-functional card number created for the purpose of testing payment gateways, fraud detection tools, and transaction workflows. These numbers follow real credit card validation rules, such as the Luhn algorithm, but they do not have actual funds or banking association. They allow developers and businesses to test payment systems without the risks associated with using real financial data.

Testing credit card numbers is essential for businesses to ensure smooth payment processing and detect potential issues before going live. Whether testing checkout flows, fraud prevention, or CVV authentication, using credit card numbers for testing correctly can save time and prevent costly mistakes.

As online payments continue to evolve, integrating a payment orchestration platform can simplify credit card testing numbers and provide merchants with a seamless, fraud-resistant transaction experience.

Contact Gr4vy today to learn how payment orchestration can enhance your payment testing and security strategies.