November 7, 2024

Popular payment methods in Europe: Localized payment solutions

- Why understanding European payment preferences Matters

- Key Payment Methods Across Europe

- Credit and Debit Cards

- Bank Transfers

- Digital Wallets

- Country-specific payment methods in Europe

- Germany

- Netherlands

- France

- United Kingdom

- Sweden

- Popular payment methods by region

- Western Europe

- Eastern Europe

- Northern Europe (Nordics)

- Southern Europe

- Growth of Contactless Payments

- Buy Now, Pay Later (BNPL) Options

- Digital Wallet Adoption

- Decrease in Cash Usage

- Practical tips for businesses: Choosing the right payment methods

- Frequently Asked Questions (FAQs)

- What is the most common payment method in Europe?

- What is the most popular digital wallet in Europe?

- What are the alternative payment methods in Europe?

- What is the biggest payment provider in Europe?

- What is the most common international payment method?

- Gr4vy’s role in supporting payment methods in Europe

For any business looking to make headway in Europe, understanding how people prefer to pay is more than just a smart move—it’s essential. Across Europe, payment habits vary widely, shaped by culture, technology, and regional trends. What’s popular in one country might be less so in another, making it critical for companies to cater to these preferences to build trust and drive sales.

In this guide, we’ll dive into the most popular payment methods across Europe, explore the distinct trends in different regions, and share practical tips to help businesses offer a seamless payment experience. Whether you’re looking to expand into new European markets or simply want to refine your existing strategy, this overview will help you meet the needs of European customers and stay competitive in an ever-evolving market.

Why understanding European payment preferences Matters

In Europe, payment preferences aren’t one-size-fits-all. For businesses targeting this market, aligning with local payment preferences is crucial. Failing to do so may result in lower conversion rates, higher cart abandonment, and, ultimately, lost revenue. Customers in Europe value convenience, security, and familiarity, making it vital for companies to offer the right payment mix that appeals to each demographic.

Providing local payment methods also builds trust. European customers are accustomed to options like iDEAL in the Netherlands and Giropay in Germany. When businesses offer these familiar choices, customers are more likely to complete their purchases, knowing they can rely on trusted, secure payment methods.

Key Payment Methods Across Europe

Let’s examine the dominant payment methods and their regional variations, as well as trends and considerations when choosing the right mix for European consumers.

Credit and Debit Cards

Credit and debit cards are widely used across Europe, but adoption and usage patterns vary by country. In places like the UK and France, credit cards (Visa, Mastercard) are standard, while Germany and the Netherlands have a strong preference for debit cards over credit.

For businesses, offering both credit and debit card options is essential. However, businesses should also consider contactless payment options associated with these cards, as the COVID-19 pandemic accelerated demand for contactless solutions, especially for in-store purchases. In many cases, adding options like Visa and Mastercard with contactless support can enhance convenience and appeal to a broader audience.

Bank Transfers

Bank transfers are a preferred payment method in Europe, particularly in countries like Germany, the Netherlands, and Sweden. The SEPA (Single Euro Payments Area) initiative allows for cross-border bank transfers, making it a seamless option for businesses operating within the EU. The SEPA Direct Debit system is another popular choice for recurring payments, like subscriptions and memberships.

Bank transfer solutions vary by country:

- Germany: Consumers often prefer methods like Giropay and Sofort, which allow real-time bank transfers.

- Netherlands: iDEAL is the dominant online payment method, highly trusted and widely used.

- Sweden: Swish is popular for bank-to-bank transfers, especially for mobile transactions.

Digital Wallets

The popularity of digital wallets is growing rapidly across Europe, with younger generations leading this shift. Wallets such as Apple Pay, Google Pay, and PayPal are prevalent, enabling customers to make secure, fast payments online and in-store. Mobile payment adoption rates are particularly high in the UK, France, and Nordic countries, where contactless payment technology is well-integrated.

For businesses, supporting digital wallets can be a competitive advantage, particularly in regions where mobile commerce is booming. Consumers increasingly expect to be able to use their smartphones for transactions, and digital wallets meet this demand effectively.

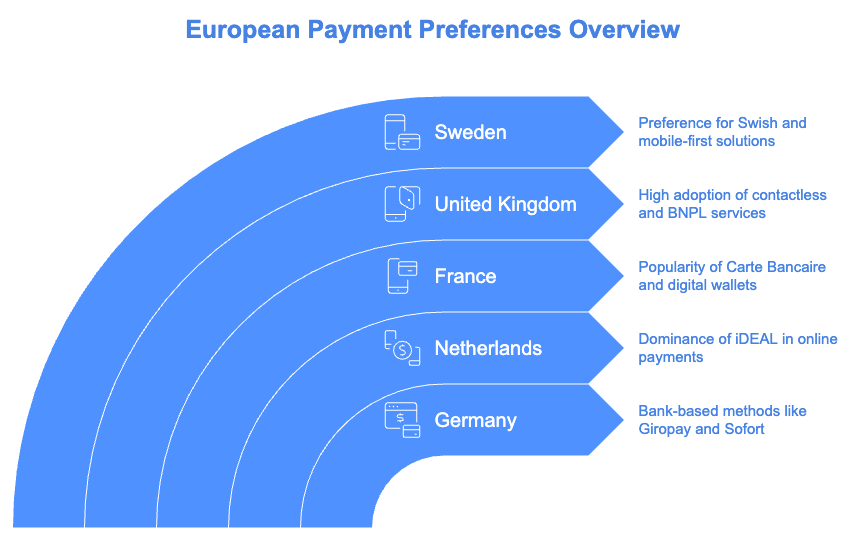

Country-specific payment methods in Europe

To succeed in Europe, businesses must cater to country-specific payment preferences. Here’s a closer look at the most popular methods in key markets:

Germany

German consumers favor bank-based payment methods. Credit card use is less common than in other countries, with many opting for direct debit options and local solutions like Giropay and Sofort. These methods are bank-linked, offering secure, real-time transactions that appeal to security-conscious German shoppers. Cash usage, while decreasing, is still notable in in-person transactions.

Netherlands

The Netherlands is highly digital in terms of payment, with iDEAL dominating online transactions. Nearly all Dutch banks support iDEAL, making it the top choice for e-commerce. For businesses targeting this market, integrating iDEAL is essential for reaching Dutch consumers, as it accounts for a large share of online purchases.

France

In France, Carte Bancaire (CB) is the most widely used payment card, while Visa and Mastercard are also common. Credit and debit cards remain popular, and digital wallet adoption is growing, with Apple Pay and Google Pay leading in mobile payments. In recent years, there’s been a shift towards mobile and contactless solutions, particularly among younger consumers.

United Kingdom

The UK is a leader in digital payments, with high adoption of contactless cards and digital wallets like Apple Pay and Google Pay. Buy Now, Pay Later (BNPL) services, such as Klarna and Clearpay, have also gained popularity, especially among millennials. Businesses aiming to succeed in the UK should consider offering a wide variety of digital and alternative payment methods.

Sweden

Sweden’s payment landscape is one of the most advanced, with Swish being a popular mobile payment method. Cash usage is nearly obsolete, and digital wallets, alongside debit cards, are preferred for both in-store and online transactions. The Swedes are tech-savvy, and businesses targeting Sweden benefit from focusing on mobile-first payment solutions.

Popular payment methods by region

Europe can be divided into regions where payment habits vary:

Western Europe

Western Europe has high rates of credit card and digital wallet usage, especially in countries like the UK, France, and Belgium. Contactless payments have become standard in these countries, driven by mobile and wearable technology adoption.

Eastern Europe

Eastern Europe is still catching up in terms of digital payment adoption. Many consumers continue to prefer cash, though digital wallet use is rising as smartphone penetration increases. Poland and the Czech Republic have strong bank transfer systems, and mobile payment solutions are becoming more popular among urban populations.

Northern Europe (Nordics)

The Nordics are highly digital, with a strong preference for mobile and digital wallet payments. Countries like Sweden and Denmark lead in cashless transactions, and bank transfers through mobile solutions like Swish are common.

Southern Europe

In Southern Europe, credit cards and bank transfers are commonly used, but cash is still prevalent in countries like Italy and Spain. Digital wallets are gaining traction, but adoption is slower compared to Northern Europe.

| Region | Popular Payment Methods | Notes |

| Western Europe | – Credit and Debit Cards (Visa, Mastercard) | Contactless payments are widely adopted. |

| – Digital Wallets (Apple Pay, Google Pay, PayPal) | France, UK, and Belgium lead in mobile wallet adoption. | |

| – Bank Transfers (SEPA Direct Debit) | Common for recurring payments and high-value transactions. | |

| Eastern Europe | – Cash | Still widely used in certain areas, particularly in rural regions. |

| – Bank Transfers (SEPA) | Popular in Poland and the Czech Republic. | |

| – Digital Wallets (PayPal, Apple Pay) | Growing adoption, especially in urban areas and among younger populations. | |

| Northern Europe | – Digital Wallets (Swish in Sweden, MobilePay in Denmark) | High mobile payment adoption, low cash usage. |

| – Credit and Debit Cards | Contactless and mobile payments are common. | |

| – Bank Transfers (SEPA) | SEPA transfers are widely used and trusted. | |

| Southern Europe | – Credit and Debit Cards (Visa, Mastercard) | Credit cards are standard, but digital wallets are gradually gaining traction. |

| – Cash | Cash remains common, especially in countries like Italy and Spain. | |

| – Digital Wallets (Apple Pay, Google Pay) | Slowly increasing in popularity with younger consumers. |

Key trends in european payment methods

European payment trends are continuously evolving. Some key trends include:

Growth of Contactless Payments

Contactless payments saw significant growth during the COVID-19 pandemic. In many countries, consumers have come to expect contactless options for in-store purchases, whether through contactless-enabled cards or digital wallets.

Buy Now, Pay Later (BNPL) Options

BNPL options like Klarna, Clearpay, and Afterpay are rapidly expanding in Europe. They’re particularly popular with younger consumers who prefer flexible payment options. Businesses can benefit from integrating BNPL solutions, especially for e-commerce transactions.

Digital Wallet Adoption

Digital wallets are becoming standard payment methods, with rapid adoption across the continent. Apple Pay, Google Pay, and Samsung Pay are widely accepted, and local solutions like Swish (Sweden) and MobilePay (Denmark) are expanding.

Decrease in Cash Usage

Cash is declining across Europe, with many countries aiming to become cashless. Sweden is at the forefront, with plans to phase out cash entirely, while other countries see digital payments replacing cash, especially in urban areas.

Practical tips for businesses: Choosing the right payment methods

For businesses, the diversity of payment preferences in Europe can be challenging. Here are some actionable tips for selecting the right payment methods:

- Offer Multiple Payment Options: Give customers a variety of choices, including credit cards, bank transfers, and digital wallets. This inclusivity increases the likelihood of conversion.

- Consider Country-Specific Solutions: Integrate local payment solutions like iDEAL in the Netherlands and Giropay in Germany to meet regional expectations.

- Optimize for Mobile: Ensure that payment interfaces are mobile-friendly, as mobile commerce is significant in Europe. A smooth mobile checkout process is essential.

- Prioritize Security: European consumers are increasingly concerned about data privacy. Use secure payment solutions and communicate your commitment to data protection to build customer trust.

- Utilize a Payment Orchestration Platform: Solutions like Gr4vy’s orchestration platform allow businesses to integrate multiple payment providers effortlessly, customizing payment options based on country-specific needs.

Frequently Asked Questions (FAQs)

What is the most common payment method in Europe?

Credit and debit cards remain the most common payment methods, with digital wallets and bank transfers also popular depending on the country.

What is the most popular digital wallet in Europe?

PayPal leads digital wallet usage across Europe, with Apple Pay and Google Pay also gaining significant traction, especially in Western Europe.

What are the alternative payment methods in Europe?

Alternative payment methods include buy now, pay later (BNPL) options like Klarna, direct bank transfers, and local methods like Giropay in Germany and iDEAL in the Netherlands. Learn more about Alternative payment methods in this article.

What is the biggest payment provider in Europe?

Major players include Visa, Mastercard, and PayPal, along with region-specific providers like SEPA for bank transfers within the EU.

What is the most common international payment method?

Credit cards and digital wallets are widely accepted across borders, while SEPA bank transfers facilitate cross-border payments within the EU.

Gr4vy’s role in supporting payment methods in Europe

For businesses expanding in Europe, Gr4vy’s payment orchestration platform offers an efficient way to manage and integrate multiple payment options. With support for credit cards, digital wallets, and local payment methods, Gr4vy helps businesses deliver seamless payment experiences tailored to each country’s needs.

How does Gr4vy help businesses with payment methods in Europe?

Gr4vy enables businesses to manage multiple payment providers across Europe, ensuring seamless transactions tailored to each country’s payment preferences.

Can Gr4vy support local payment methods?

Yes, Gr4vy supports a variety of local methods, helping businesses cater to country-specific needs and improve their payment conversion rates. Check out Gr4vy’s integrations.

Does Gr4vy support digital wallets in Europe?

Absolutely, Gr4vy integrates with digital wallets like Apple Pay, Google Pay, and PayPal to meet the rising demand for mobile and contactless payments across Europe.

Understanding Europe’s diverse payment preferences is crucial for any business aiming to succeed in this market. By offering a tailored mix of payment options that resonate with local customers, companies can create a smoother purchasing experience, build trust, and ultimately increase sales. With trends like digital wallets and contactless payments gaining ground, staying agile and responsive to these shifts can be a true competitive advantage.

For businesses looking to simplify payment management, Gr4vy’s payment orchestration platform offers the flexibility to integrate and optimize payment methods across different countries. Ready to streamline your payment strategy? Contact Gr4vy to learn how their platform can support your expansion and help you connect with customers across Europe.